You may now submit or update your beneficiary designation(s) electronically by logging into MyLAFPP, your member self-service portal. Updating your beneficiary designation through MyLAFPP is the fastest, easiest, and secure way to make beneficiary changes. Your changes will immediately update your pension record without any delays!

Please refer to the Helpdesk for step-by-step instructions on how to register for MyLAFPP/request a PIN, update your beneficiary designation, recover your username, reset a password, and other helpful tools.

You may also update your beneficiary information by submitting a completed Designation of Beneficiary form. You can submit the form through MyLAFPP, which is the preferred and secure option for sending files to LAFPP. The Designation of Beneficiary form is available on our website under Resources & Forms. You can also send it by by mail, fax to (213) 628-7716, or by email to amssection@lafpp.com.

In the event that you pass away prior to retirement, circumstances may only allow for a refund of your pension contributions and accrued interest to your designated beneficiary – not a Survivor Pension. If you do not have a beneficiary designation on file with LAFPP:

- Your pension contributions and accrued interest will be paid based on the Plan’s order of succession as stated in the City Charter and Administrative Code provisions: 1) Spouse or State-Registered Domestic Partner; 2) Children; 3) Parents; 4) Executor or Administrator of your estate, or to any other person legally authorized to collect money due to you. If the Plan’s order of succession is insufficient to pay a beneficiary, then the California Intestate Succession laws will be applied. See California Intestate Section 6402 for more information.

- Additionally, if your total estate (including your pension contributions and accrued interest) is greater than the prescribed limit found in California Probate Code Section 13100, then probate proceedings will need to be initiated.

As an active member, it is very important to maintain a current beneficiary designation with LAFPP. Doing so ensures that your pension contributions and accrued interest will be paid to the person(s) of your choice and the refund will not be delayed by probate, regardless of your estate’s value.

Note: Should you pass away and leave someone eligible for a survivor pension (i.e., spouse/domestic partner, minor/dependent children, dependent parent), your contributions and accrued interest will not be refunded, although your eligible survivor(s) may receive your contributions as part of the Basic Death Benefit, if applicable.

Please review the Qualified Survivor Handbook for more information on survivor benefits.

Follow the instructions below to learn how to update your beneficiaries online.

Important: In order to access your information, you must first register to the MyLAFPP member portal. Please refer to the MyLAFPP Helpdesk on how to register and other helpful self-service “How-to’s.”

1

Enter your username and password, then click Log In.

Important: Usernames and Passwords are case sensitive.

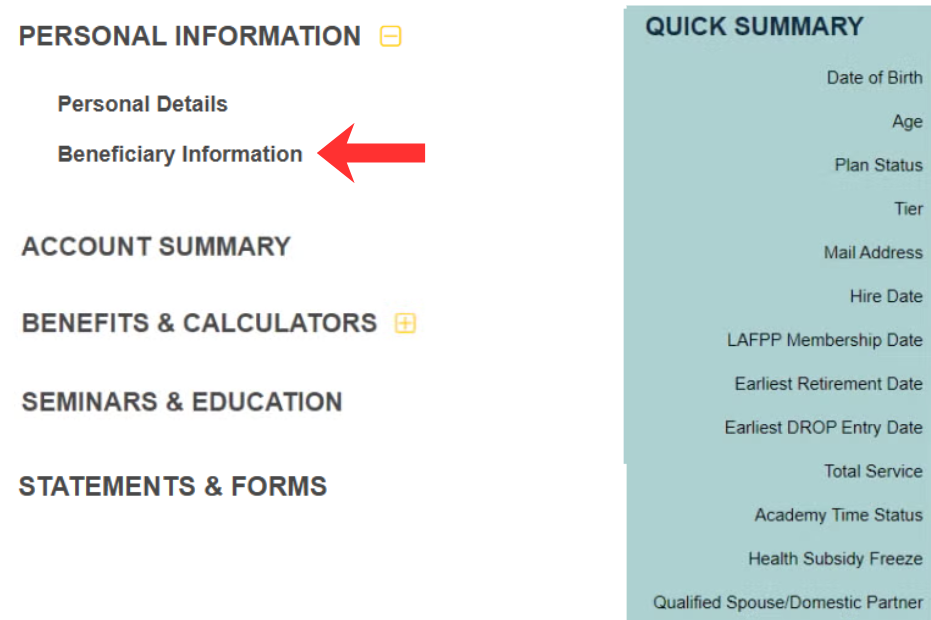

2

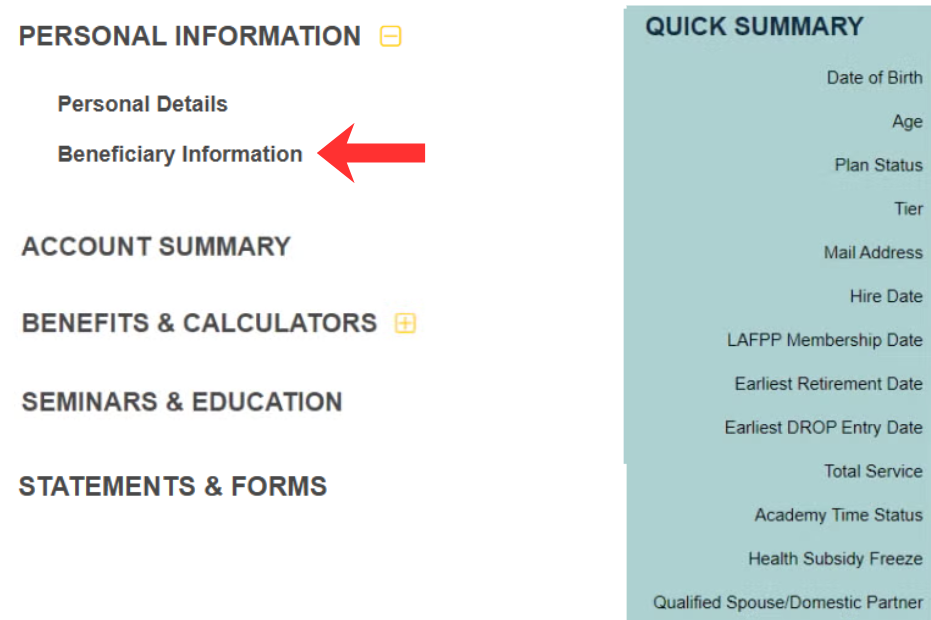

Click Beneficiary Information

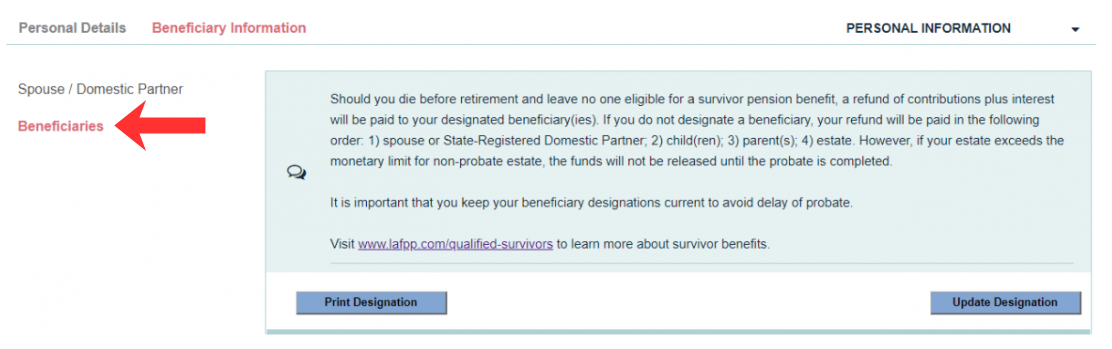

3

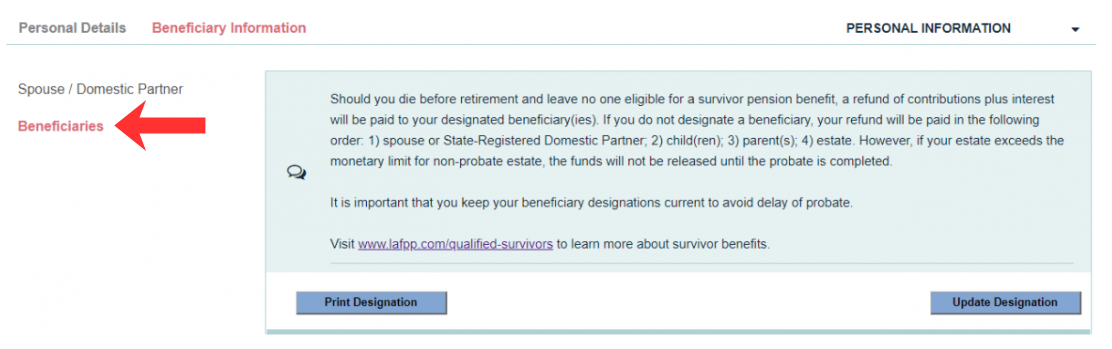

Click “Beneficiaries”

4

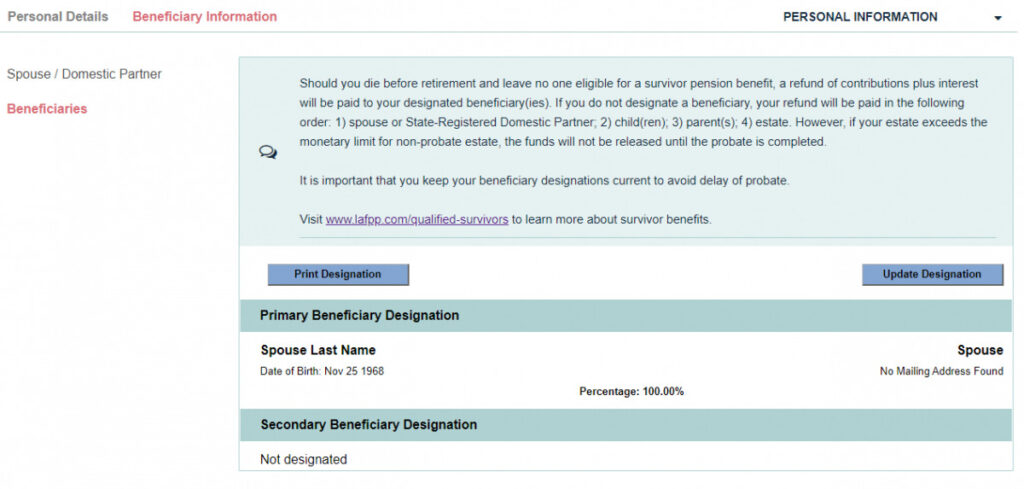

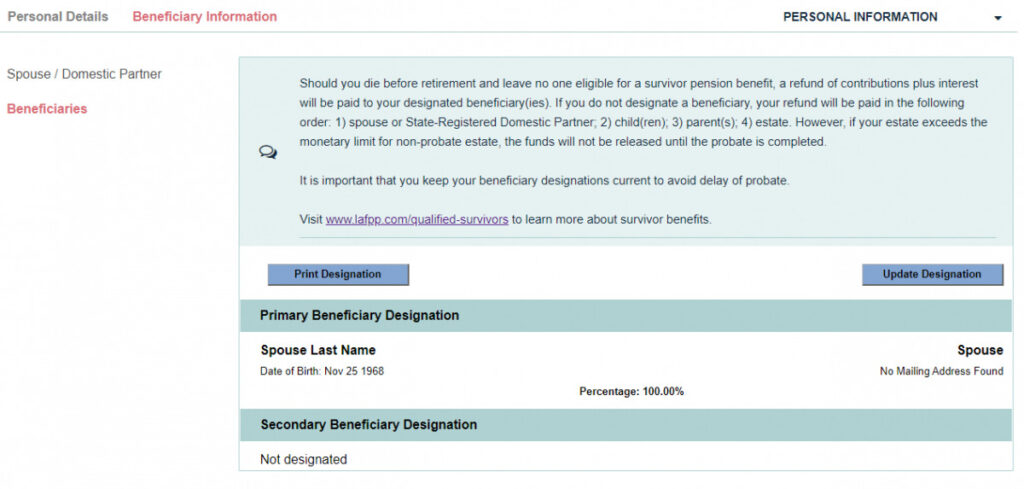

Review Your Elected Beneficiaries

Click “Update Designations” to make changes or “Print Designations” to print a copy.

5

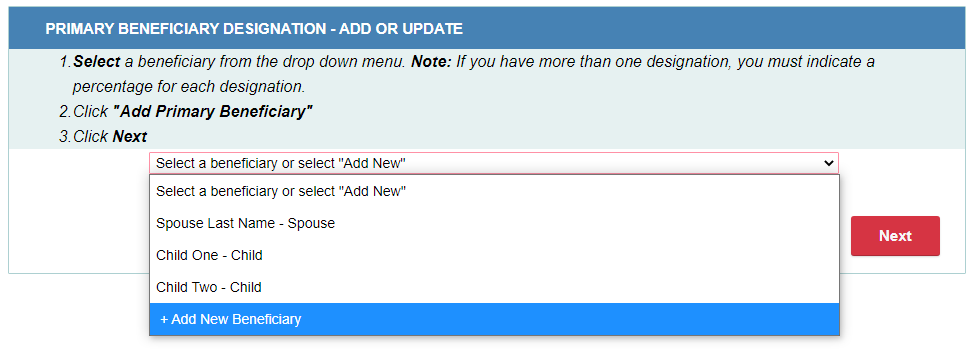

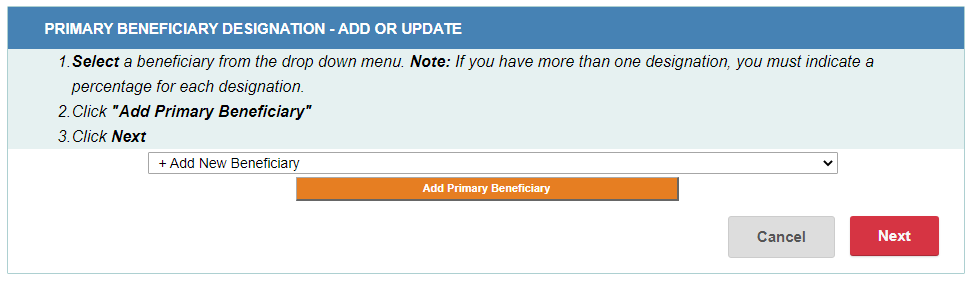

Add or Update Your PRIMARY Designation

You will be asked to provide a SECONDARY (contingent) designation later. NOTE: You will not be able to designate the same individuals for Primary and Secondary.

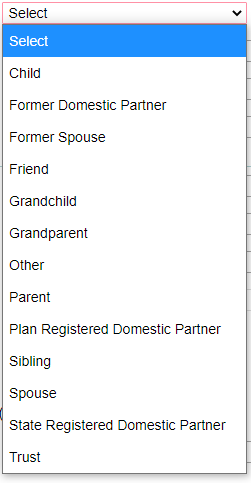

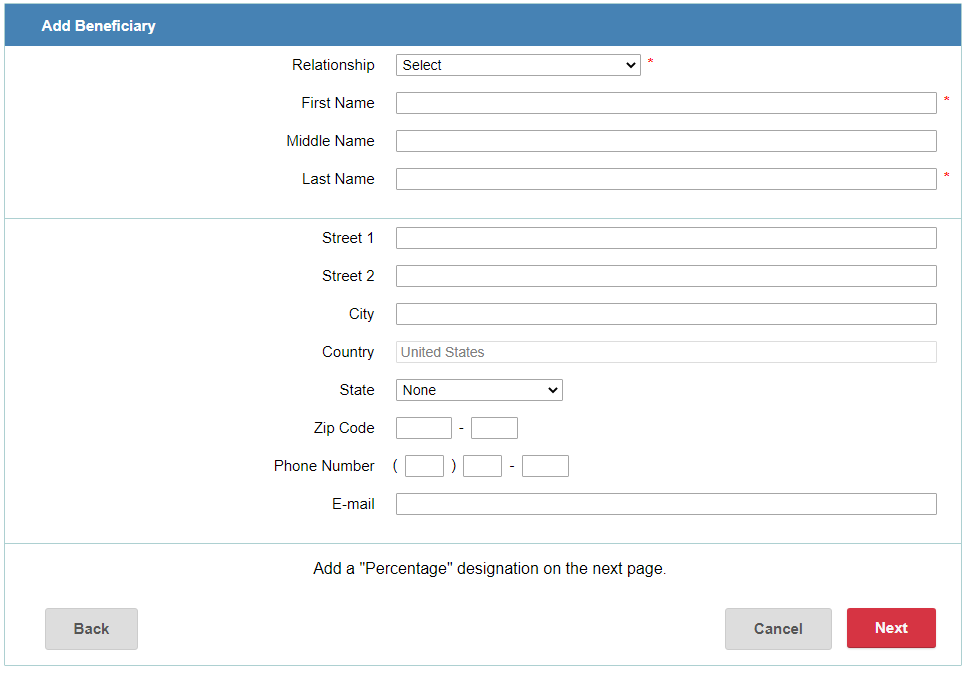

To add a NEW beneficiary:

5

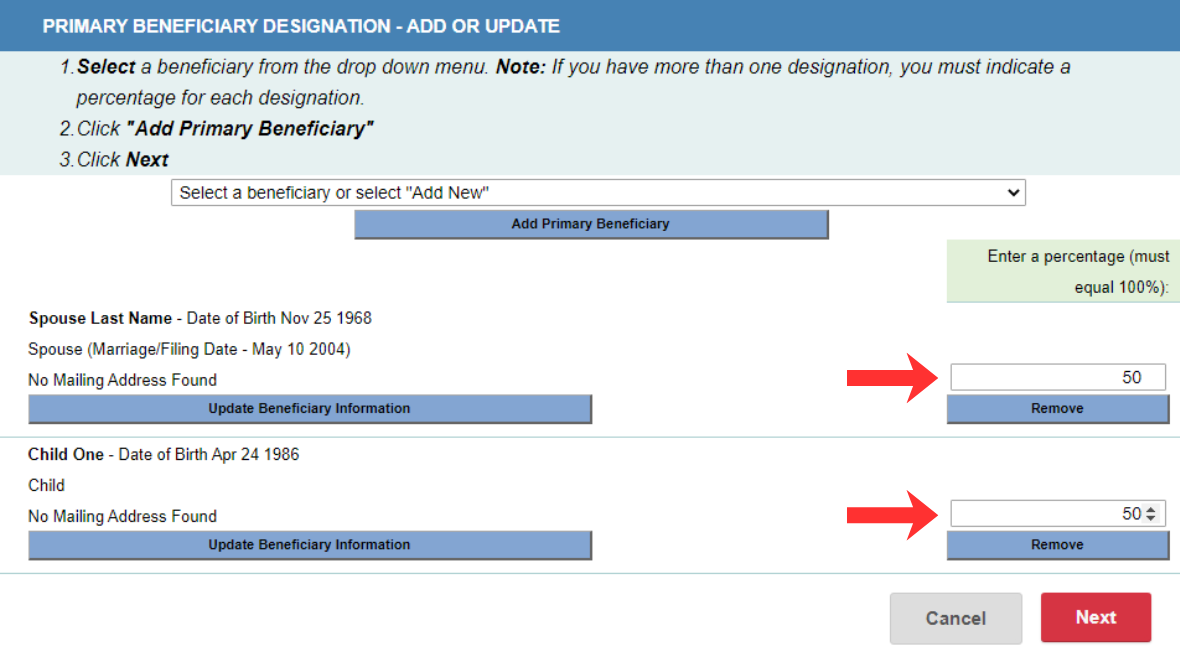

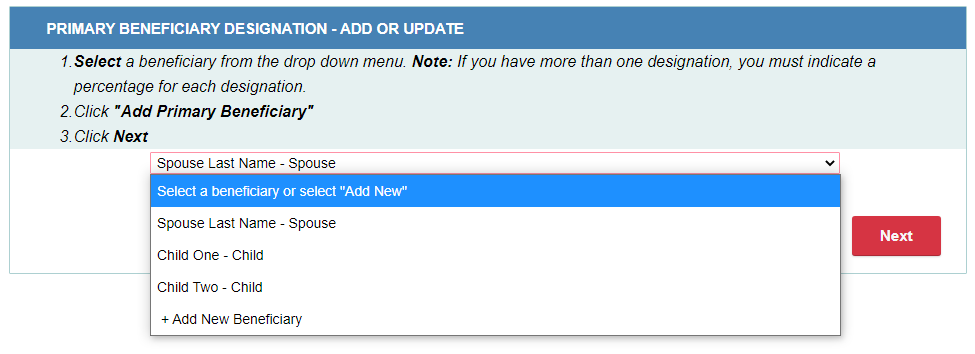

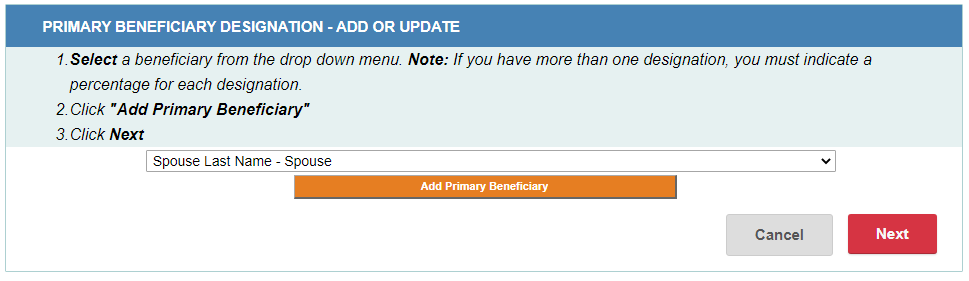

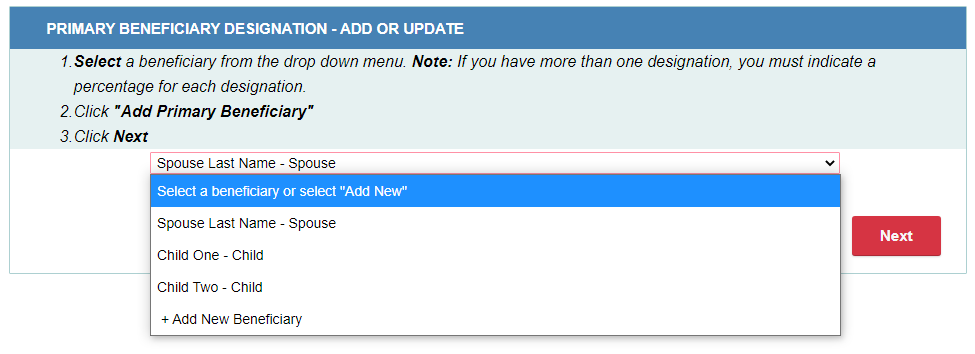

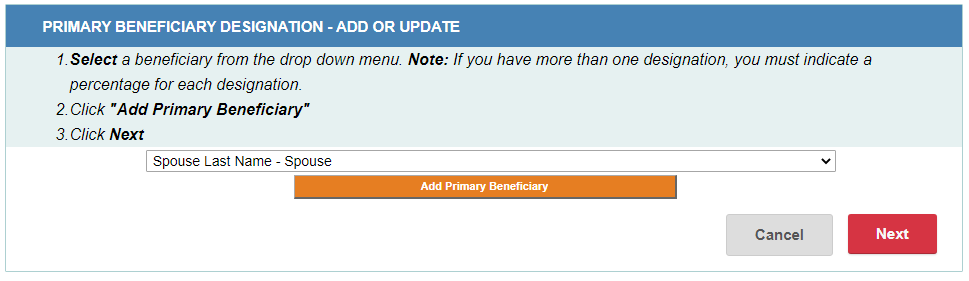

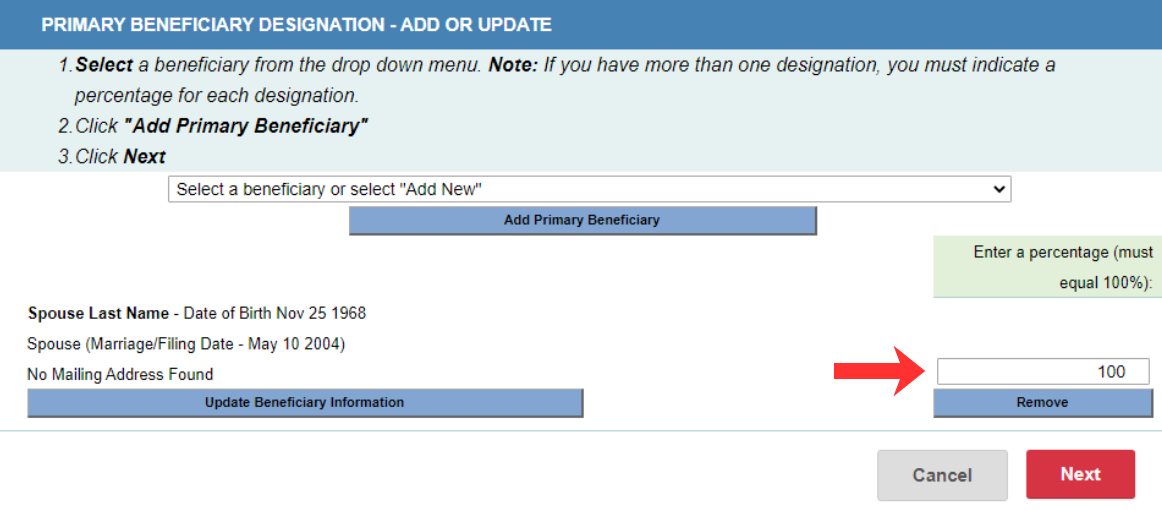

To add EXISTING beneficiaries:

- A. Select an existing beneficiary from the drop down box.

- B. Click “Add Primary Beneficiary”

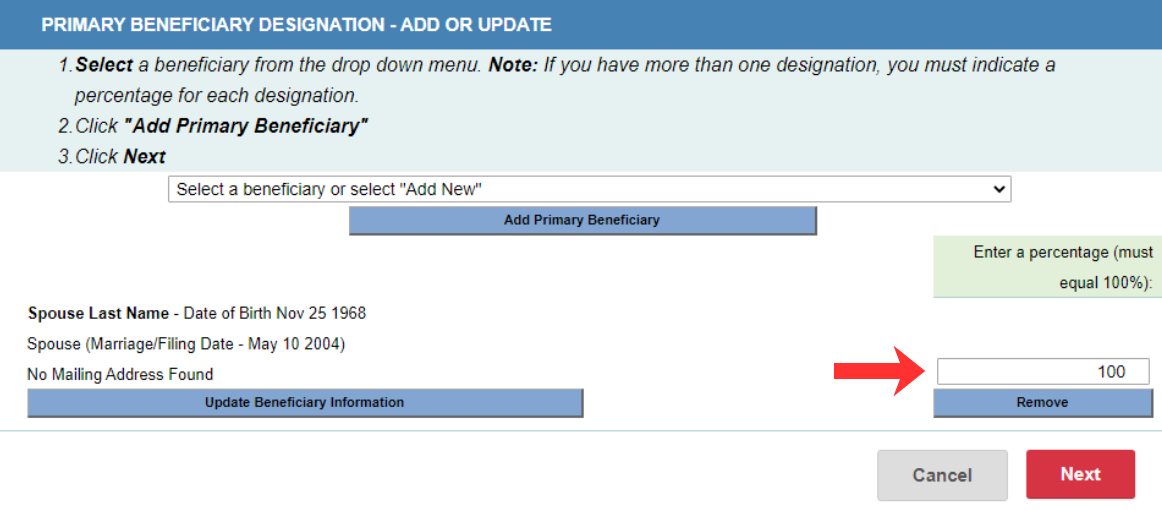

- C. If you would like to add more than one PRIMARY designation, repeat steps A and B or to add a “NEW” person/entity follow steps A-E for adding NEW beneficiary above.

- D. Enter the percentage (in whole numbers) you would like to designate. Click Next.

6

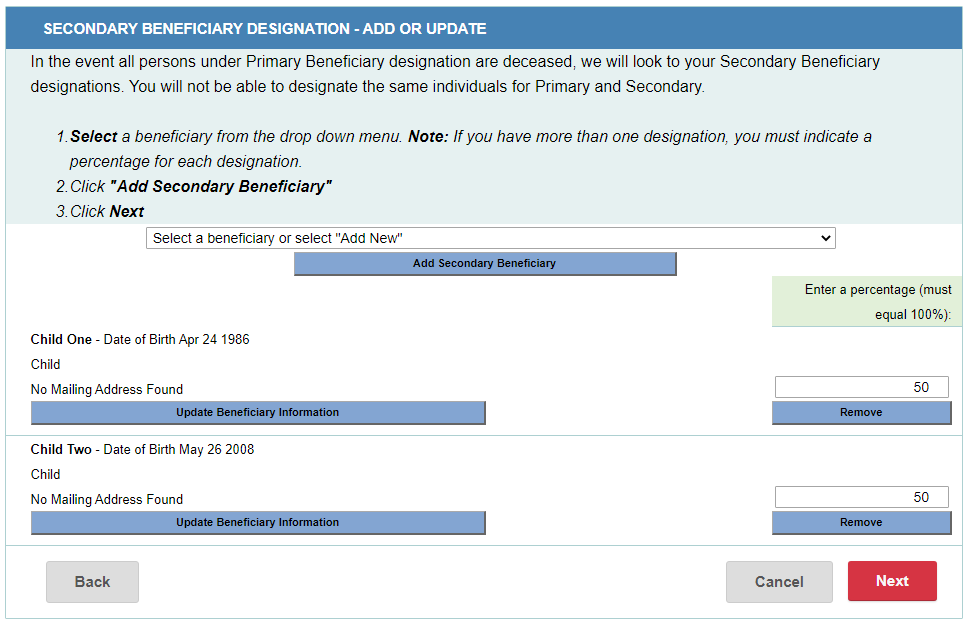

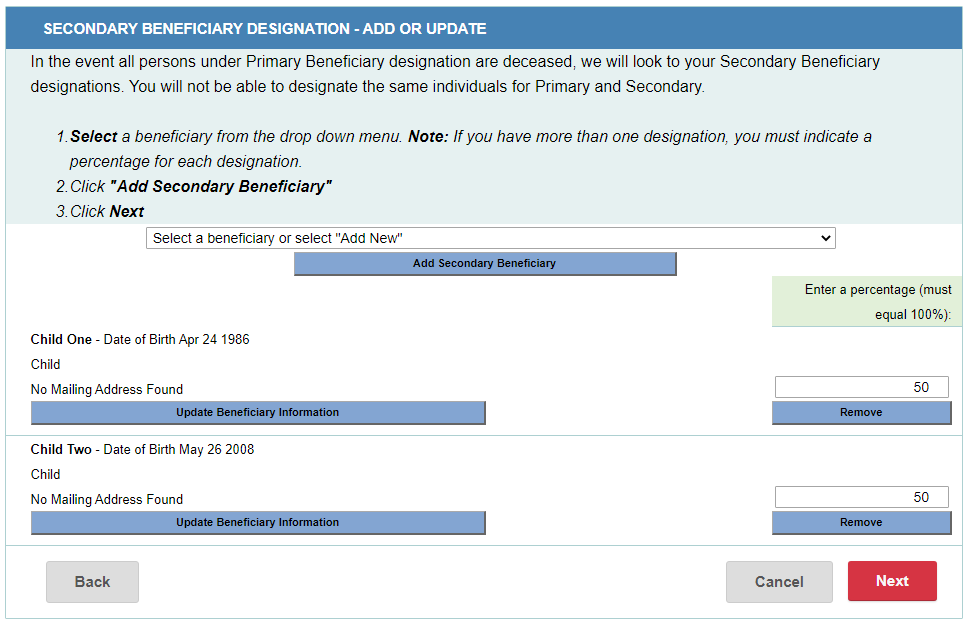

Add or Update Your “Secondary” Designation

To add designations, follow instructions provided in Step 5. Click Next.

NOTE: In the event that all persons under Primary Beneficiary designation are deceased, we will look to your Secondary Beneficiary designations. You will not be able to designate the same individuals for Primary and Secondary.

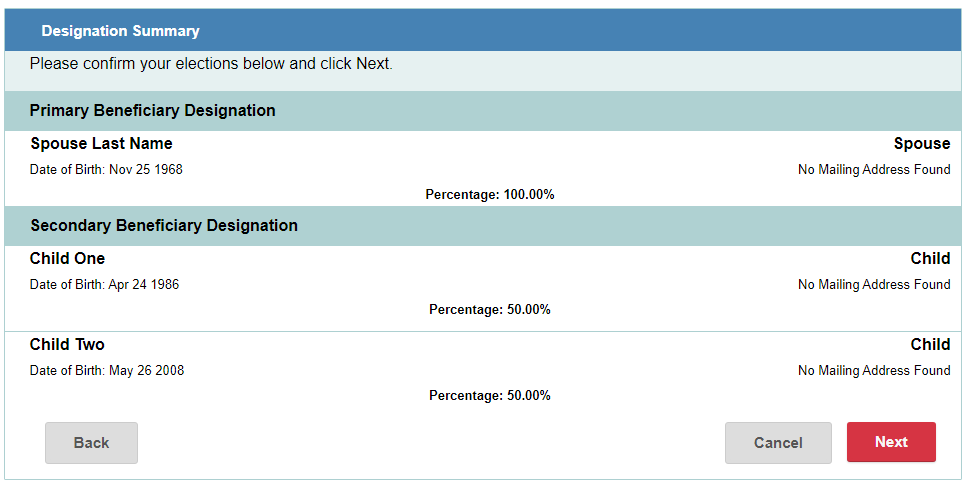

7

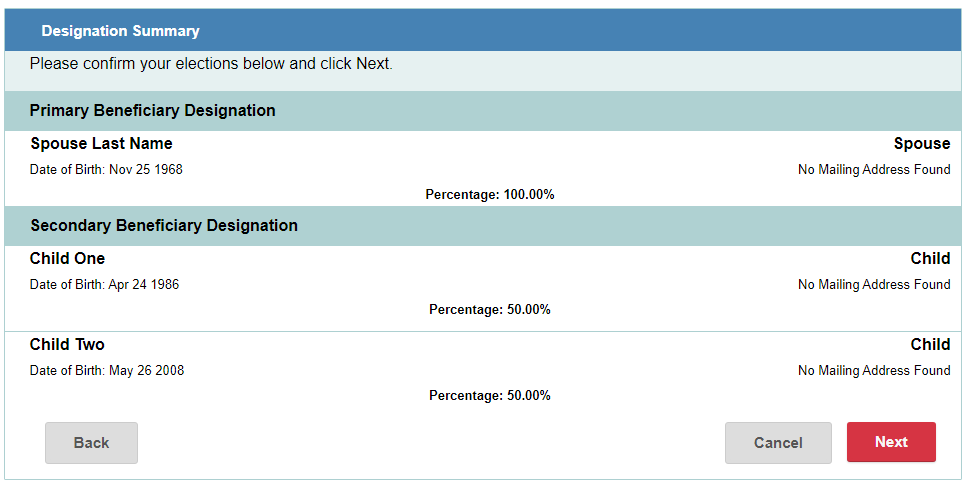

Confirm Your Elections

The summary screen shows you the latest changes you made. Click “Back” to change your elections, otherwise, click “Next”.

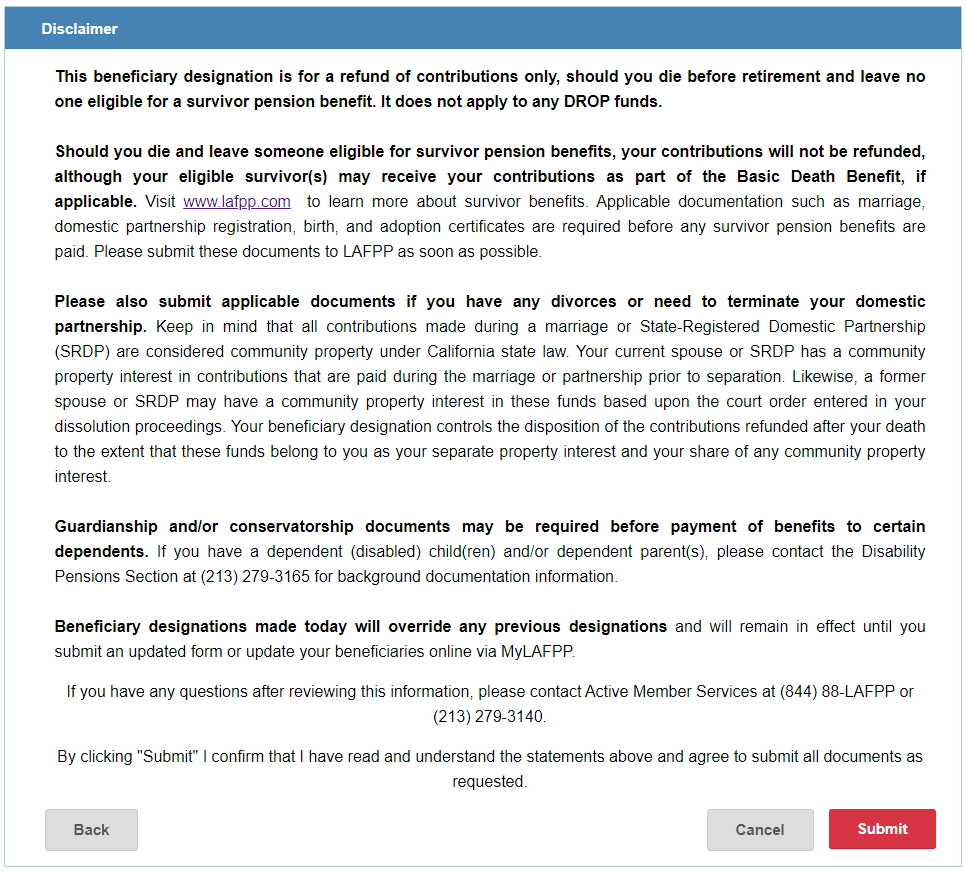

8

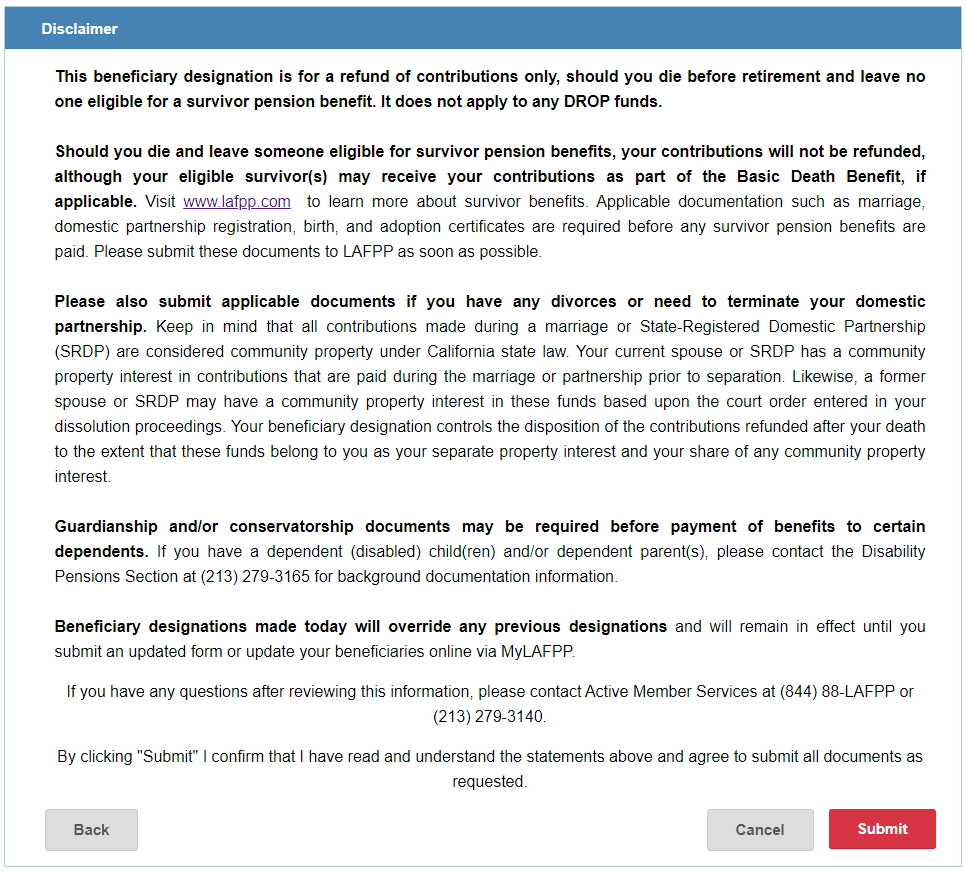

Read Disclaimer and Click Submit to Process Your Designations

A confirmation screen will open to let you know your elections have been submitted. Click on “Beneficiaries” Menu to return and view a summary of your designations. You may print a copy for your records or update your elections at any time.

Questions?

If you have any questions regarding beneficiary designation, please contact the Active Members Services Section at (213) 279-3140 or by email at amssection@lafpp.com.