Have you opted to receive your pension payments via direct deposit? Electing direct deposit is a quick and secure way to receive your pension payments electronically and it saves time from going to the bank. If your paper check is lost in the mail or you misplace it, getting a replacement check can take up to six weeks from the original payment date.

If you plan to start the process, make a change or cancel your Direct Deposit, you may do so from MyLAFPP or by downloading and completing a Direct Deposit Form.

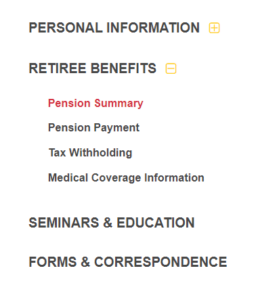

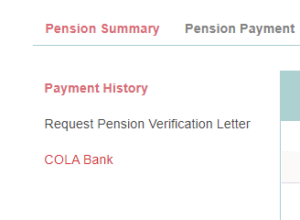

You can start, change or cancel your direct deposit by using MyLAFPP. Once you login to MyLAFPP, navigate to Retiree Benefits > Pension Payment > Update Pension Payment. There is no need to provide any forms if you sign up for direct deposit using MyLAFPP.

If you prefer to use a paper form, please download and submit a completed Direct Deposit Form to the Retirement Services Section. You can submit your form by mail, email (rs@lafpp.com) or fax (213) 628-7716. Follow the instructions on the form to ensure that your information is complete and accurate. If you are starting or changing your Direct Deposit information, please include a canceled or voided check with your form. Depending on when your form is received, it may not be processed until the month following receipt.

Things to Consider

1

Once you set up your Direct Deposit account, your payment will automatically be deposited on the last business day of each month – see the Pension Payment Schedule for actual dates. However, the availability of funds may vary according to your financial institution. Your pension benefit statement will continue to be mailed to the mailing address we have on file; there is no option to remove such mailing.

2

When changing or canceling your Direct Deposit, we recommend leaving your existing account open until your request has been completed. If your account is closed prematurely, you will need to wait for our receipt of the returned payment which will delay its reissuance. Please notify the Retirement Services Section immediately to prevent lengthy delays.

3

If you experience difficulties with your Direct Deposit account, fixes can be made to your account information for payment the next business day.

4

If you are still receiving a paper check, it can be damaged, delayed due to weather, lost in the mail, or misplaced. To have your check reissued, you must complete a Lost Check Affidavit and submit it to the Retirement Services Section. Please note there are only two payment dates per month. Depending on when your affidavit is received, this process can take up to six weeks from the original payment date.

If you have questions regarding your Direct Deposit election, please contact the Retirement Services Section at (213) 279-3125 or by email (rs@lafpp.com).