We invite you to read our newsletter filled with announcements and benefit topics including 2025 Health and Dental Subsidy, Medicare Part B Reimbursement, Tax Season Form 1099-R Information, and 2025-2027 Strategic Plan.

Category: Newsroom

December 2025 Retired/DROP Newsletter Is Now Available

We invite you to read our newsletter filled with announcements and benefit topics including 2026 Health and Dental Subsidy updates, Tax Season 1099-R Form information and more.

June 2025 Retired/DROP Newsletter Is Now Available

We invite you to read our newsletter filled with announcements and benefit topics including 2025 Cost of Living Adjustment, 2025 Non-Medicare Retiree Health Subsidy Increase and more.

August 2024 Active/DROP Newsletter Is Now Available!

We invite you to read our newsletter filled with announcements and benefit topics including Workday Implementation-What You Should Know, Upcoming Changes to MyLAFPP, and more.

Click Here to view Newsletter!

May 2024 Active/DROP Newsletter Is Now Available!

We invite you to read our newsletter filled with announcements and benefit topics including Active member annual statements, the City of Los Angeles’ new Human Resources and Payroll (HRP) project, and more.

Click Here to view Newsletter!

LAFPP Joins IDiF Fireside Chat on the Emerging Manager Program

On January 23rd, LAFPP’s Susan Liem of the Investments Division joined a “fireside chat” hosted by The Institute for Diversity and Inclusion in Finance (IDiF). This virtual event included a discussion on LAFPP’s private equity Specialized Manager program. Susan was joined by Kirk Sims, Head of the Emerging Manager Program at Teachers Retirement System of Texas.

Click on the link to view the video: IFiF Fireside Chat: Emerging Manager Programs

The Institute for Diversity and Inclusion in Finance (IDiF)’s mission is to expand access to institutional capital and amplify efforts to increase diversity in the finance industry. The organization partners with investment firms, academics and regulators to advance its mission through education and alliances. IDiF has monthly virtual events that bring together investment practitioners and thought leaders together for discussions on various DEI related investment topics. For more information on IDiF or register for future events, please visit www.idif.org.

We’ve Moved! – LAFPP.com is now LAFPP.lacity.gov

In an effort to increase security and modernize the City’s online presence, LAFPP has partnered with the City’s Information Technology Agency (ITA) to move our website to its new address: https://LAFPP.lacity.gov.

These “.gov” domains are only issued to official local, county, and state government organizations in the United States. The updated .gov domain name provides additional security protections and assures visitors that the information they are viewing is from a legitimate government agency and authentic. The transition reinforces our commitment to a secured digital presence and makes it more difficult for malicious actors to defraud the public.

To aid in this transition, members and visitors who enter our old website address (www.lafpp.com) will be redirected to our new location: lafpp.lacity.gov.

We encourage you to update your web browser bookmark and visit us at our official website: https://LAFPP.lacity.gov

Official websites use “.gov” – A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS – https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Related Links

TAX SEASON – 1099-R INFORMATION

As you prepare to file your taxes, below are a couple of options for obtaining your 2023 Form 1099-R tax information:

Available online beginning January 31, 2024

You may view and/or print a copy of your 1099-R tax form by logging into your MyLAFPP portal. See below for a tutorial on how to access MyLAFPP.

Mailed on January 31, 2024

If you prefer to wait for a hard copy of your 1099-R tax form, it will be mailed to your address on file via U.S. mail on January 31, 2024. Please allow up to 10 business days to receive your 1099-R by mail. If you have not received your 1099-R form by February 15, 2024, please contact the Accounting Section at (213) 279-3040, (844) 88-LAFPP ext. 3040, or via email at accounting@lafpp.com to request a copy.

FAQs

MyLAFPP tutorial how to download your 1099-R

Important: In order to access your information, you must first register to the MyLAFPP member portal. Please refer to the Register to MyLAFPP manual located in our MyLAFPP Helpdesk.

STEP 1: Log in to MyLAFPP. Enter your username and password, then click Log In.

Important: Usernames and Passwords are case sensitive.

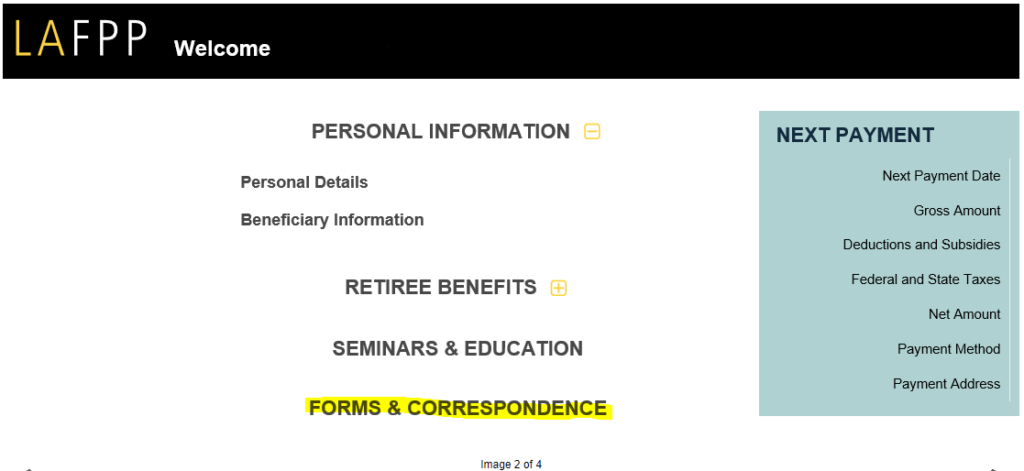

STEP 2: Click on “Forms & Correspondence”

STEP 3: Click “Statements”

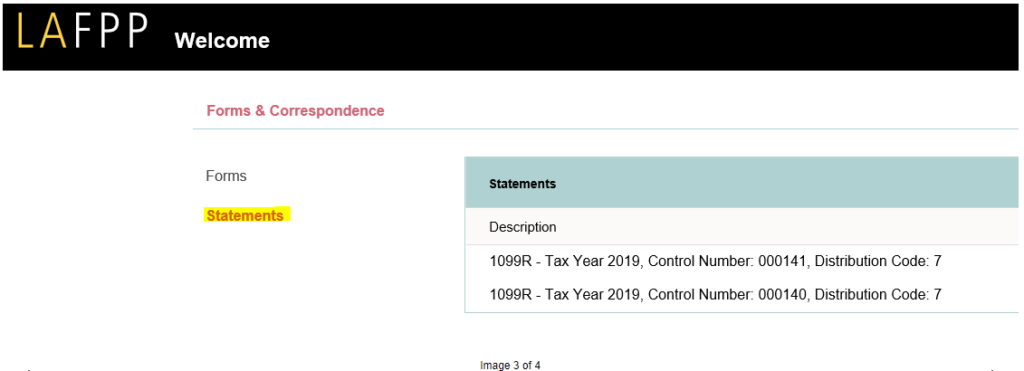

STEP 4: Click “Document” to Open or Download Your Form 1099R

Some members may receive more than one 1099-R tax form in a year. Here are some possible reasons why:

- You exited DROP and received the proceeds of your DROP account via a rollover, a lump-sum cash distribution, and received at least one monthly pension check in the same year. In this case you would receive a total of three 1099-Rs. One 1099-R for the DROP rollover (Distribution Code G), one 1099-R for the DROP lump-sum (Distribution Code 1, 2 or 7), and one 1099-R for monthly pension payments (also Distribution Code 1, 2 or 7).

- You have a non-tax dependent covered on your LAFPP-subsidized health insurance plan (e.g., domestic partner or child of a domestic partner). This 1099-R would have a Distribution Code 9.

- Your IRS tax distribution code changed during the year (i.e., when member attains age 59 ½ by June of the same year). You would receive two 1099-Rs, one for when you were under 59.5 years old (Distribution Code 2) and another for when you were over 59.5 years old (Distribution Code 7).

- You received pension payments based on your City service and from a qualified domestic relations order (QDRO) (Distribution Code 2 or 7) or as a beneficiary (Distribution Code 4).

Reminder: if you were an active employee at any time during 2023, you will also receive a W-2 tax form from the City of Los Angeles.

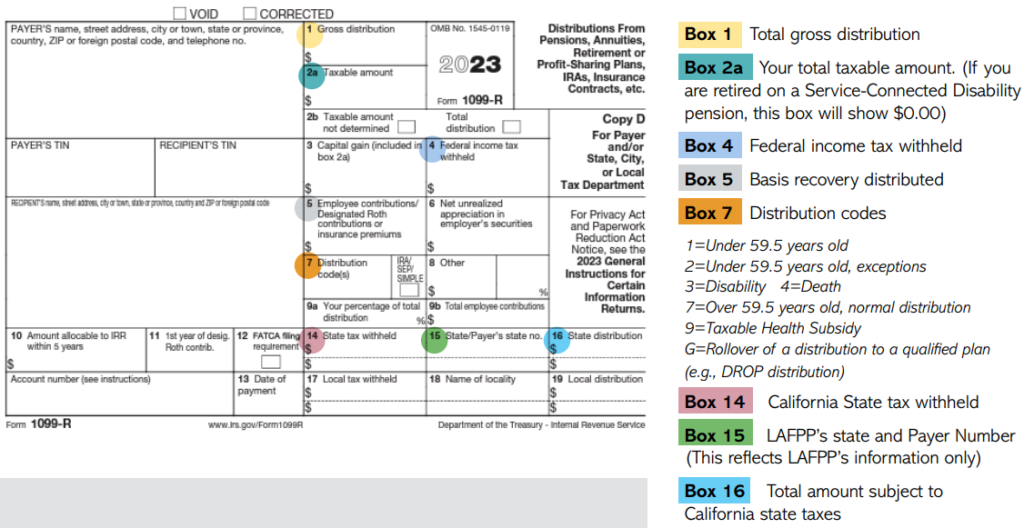

What does each box represent on the 1099-R?

Need to make changes to your income tax withholdings?

Make them electronically through the MyLAFPP portal! You can make changes in 6 easy steps:

- Access MyLAFPP

- Click Retiree Benefits

- Click Tax Withholding

- Click Update Pension Tax Withholding Instructions

- Fill in all the information, even if you are only changing either Federal or State of California withholdings.

- Click Submit

Click here for an animated tutorial of the steps above.

Important Note: In addition to Federal taxes, LAFPP is responsible for tax withholding only in the State of California. Since LAFPP does not have an operating business presence in other states, we do not offer tax withholding for states other than California. If you reside outside the State of California, no state taxes will be withheld. The State tax withheld (Box 14) and State distribution (Box 16) on your Form 1099-R will be populated with $0.00.

Tax year 2023 1099-Rs: The State/Payer’s State No. (Box 15) will continue to reflect the LAFPP Tax ID CA/800-7968-4 regardless of your state of residence. Box 15 is an administrative 1099-R field for California payers.

For questions, please contact the Retirement Services Section at (213) 279-3125 or (844) 88-LAFPP, ext. 3125.

2025 Retired Fire Election Notification – Board of Fire and Police Pension Commissioners

ELECTION NOTIFICATION

An Election to select the Fire Department Retired Member of the Board of Fire and Police Pension Commissioners (Board) is scheduled on Wednesday, March 12, 2025. The candidate elected will serve the term beginning July 1, 2025 and ending June 30, 2030.

BOARD MEMBER DUTIES – The Board exercises the prudent person standard in the discharge of its duties. It has sole and exclusive fiduciary responsibility to administer the Fire and Police Pension System (System) and its assets; has the authority to set and adopt investment policies for over $33.37 billion in fund assets (unaudited as of September 30, 2024); and has the duty to establish actuarial assumptions and adopt rules and regulations necessary to administer the System.

Preparation for regular and special meetings requires an individual to commit hours of advanced reading of Board Reports and disability cases. The Board normally meets on the first and third Thursdays of each month at 8:30 a.m. (PT). Most meetings are from three to four hours in duration. Regular in-person attendance at Board meetings is required.

ELECTION PROCESS – Only retired, sworn Los Angeles Fire Department (LAFD) members of the System are eligible to run and vote for this Board seat. Members who are interested in becoming a candidate are required to complete and submit the Notice of Intent form which was mailed with the Election Notification. Signature gathering by eligible members is not required to run as a candidate.

Along with the Notice of Intent, the candidate has the option to submit an Occupational Ballot Designation and a typewritten Statement of Qualifications. The Occupational Ballot Designation will be printed under the candidate’s name and should consist of three words to describe the following: (A) the current principal profession, vocation or occupation of the candidate, or (B) the principal profession, vocation or occupation of the candidate during the last calendar year immediately before the filing of the Notice of Intent to become a candidate. The Statement of Qualifications may include information on education, work experience, years of service, date of retirement, and other relevant qualifications and shall not exceed 300 words in length. Any words beyond the 300-word limit will not be printed.

Starting at 8:00 a.m. (PT) on Monday, December 30, 2024, candidates who wish to qualify for the ballot are required to provide the following documents: 1) Notice of Intent; 2) Occupational Ballot Designation (Optional); and 3) Statement of Qualifications (Optional). The three (3) approved methods of submittal are detailed below. Documents received any other way will NOT be accepted.

- Hand Delivery: Candidates may hand deliver the completed forms by visiting the Office of the City Clerk – Election Division (Election Division) at Piper Technical Center, 555 Ramirez Street, Space 300, Los Angeles, CA 90012.

- Mail: Candidates may submit the completed forms via U.S. Postal Service using the postage-paid envelope provided along with Election Notification.

- Email: Candidates may submit the completed forms via email to Clerk.ElectionAdmin@lacity.org.

The completed Notice of Intent must be received by the Election Division by the deadline of 5:00 p.m. (PT) on Friday, January 10, 2025.

Eligible voters will receive a ballot in the mail. Voters may choose to return their ballot via mail or may deposit it at the drop box located at the Election Division. Ballots received any other way will NOT be accepted. All completed ballots must be received by the Election Division by 5:00 p.m. (PT) on Wednesday, March 12, 2025 to be counted.

Retired, sworn members of LAFD who become eligible within 30 calendar days prior to the Election and wish to vote in the Election should obtain a Certificate of Eligibility (Certificate) from the Department of Fire and Police Pensions (LAFPP). LAFPP is located at 701 E. Third Street, Suite 200, Los Angeles, CA 90013. Beginning at 8:00 a.m. (PT) on Monday, March 3, 2025, after securing a Certificate, the newly eligible voter may present themselves in person at the Election Division and receive a ballot.

The ballots will be tallied on Friday, March 14, 2025, in the presence of candidates and their designated observers. To request the livestream of the tally please email Clerk.ElectionAdmin@lacity.org. The Election Division will furnish to the Board the official certified results of the election within 14 days after the date of election. In the event that no candidate receives a majority of all votes cast in the initial election, a runoff election shall be conducted on Wednesday, May 7, 2025, for the two (2) candidates receiving the highest number of votes.

QUESTIONS – Inquiries regarding the election process may be directed to the Election Division at (213) 978-0444 or by email at Clerk.ElectionAdmin@lacity.org. Inquiries may also be directed to the Administrative Services and Human Resources Section of the Department of Fire and Police Pensions at (213) 279-3080.

01/17/2025 UPDATE:

To All Retired (not including DROP), Sworn Fire Department Members

We extend our deepest sympathies and solidarity to all those affected by the unprecedented wildfires impacting the City and County of Los Angeles. We recognize the challenges you may be facing and want to ensure that you are still able to participate in the 2025 Election for the Fire Department Retired Member of the Board, even if your personal residence has been impacted.

Beginning Tuesday, February 18, 2025, if you require a replacement ballot, you may contact the Office of the City Clerk – Election Division through any of the following methods:

- Phone: (213) 978-0444

- Email: Clerk.ElectionAdmin@lacity.org

- In-Person: 555 Ramirez St., Space 300, Los Angeles, CA 90012,

Hours: Monday – Friday, 8:00 a.m. – 5:00 p.m. (Pacific Time)

The Election Division will provide you with an Affidavit of Loss/Non-Receipt to complete. Once the Election Division receives the completed Affidavit back – by email, mail, or in-person – they will confirm your eligibility to participate, and you will be issued a replacement ballot. Your replacement ballot can be picked up in-person from the Election Division or mailed to you via U.S. Postal Service to an alternate address. You will also receive a Business Reply Envelope, and an Identification Envelope.

Place the completed Identification Envelope with the voted ballot enclosed into the Business Reply Envelope and deposit in any U.S. Postal Service mailbox. Alternatively, you can provide Election Division the ballot in-person by use of the drop box or mail slot at their office. All ballots must be received by the Election Division no later than 5:00 p.m. on Wednesday, March 12, 2025.

LAFPP remains committed to supporting you during this difficult time and ensuring your voice is heard in this important election.

LAFPP Wishes You a Healthy and Prosperous 2024!

As 2023 ends, we wanted to reflect and express the pride we feel in taking care of you, our members. LAFPP is resolute in providing the best service to our members who dedicate their careers and risk their lives to protect the people of Los Angeles.

May the new year bring you happiness and prosperity.

In observance of the holiday, our offices will be closed Monday, January 1, 2024. We will resume normal business hours on Tuesday, January 2, 2024. To assist you during our closure and help you navigate the new year, we’ve compiled the following guide for your convenience:

Create a MyLAFPP Account

With a MyLAFPP account, you have 24/7 access to your pension-related information. You can:

- Review/update your beneficiaries

- Run retirement estimates

- View active member statements and retiree 1099-R tax forms and much more!

Pensioners: View and/or print a copy of your 1099-R tax form from your MyLAFPP portal starting January 31, 2024. Hard copies will be mailed out on the same day.

Review Your Personal Information

- Update your beneficiaries

- Check your current address (Active Members / Pensioners)

- Verify Tax Withholding Elections (Pensioners only)

- View any Lost Service Time

Attend a Seminar/Webinar

We have multiple offerings designed to fit within your busy schedule. Take a look at our upcoming schedule:

Webinars (All Tiers):

- March 13, 2024 – Financial Planning Education – 9:00am

- February 8, 2024 – Health Benefits in Retirement – 10:00am

- February 14, 2024 – Understanding Your Plan – 10:00am

- February 15, 2024 – Service Pension / DROP Entry – 10:00am

- March 13, 2024 – Financial Planning Education – 9:00am

- Additional dates available monthly!

Seminar (16+ Years of Service):

- February 28, 2024 – Financial Planning Education Seminar – 9:00am

Click on our “Helpdesk“ to view step-by-step instructions for the most common MyLAFPP tasks.

REGISTER TODAY

Learn About Your Benefits

Visit our website for:

- Publications and Guides: Disability Pension, Dissolution of Marriage

- Survivor Benefits handbook: This handbook explains the steps that survivors should take to claim their benefits.

- DROP handbook: Understand if DROP is right for you.

- New members can learn about Tier 6 benefits: New Member Walkthrough, Tier 6 FAQ brochure

- Summary Plan Description: Learn the benefits of your specific tier.

- Read our newsletters: Up-to-date news for our Active, DROP, and retired members.

Ready to Retire

If you are considering retirement in 2024, visit our “Ready to Retire” page to assist you with the process in:

- Applying for a Service Pension

- Applying to Enter DROP

- Applying for a Disability Pension

- Applying to Exit DROP

Stay Connected

Staff is available and ready to take your call during our normal business hours: Monday-Friday from 7:30 a.m. to 4:30 p.m. (except on City holidays). In the event that you are unable to reach us during these hours, you may send us a message anytime via our “Contact Us” page or by sending an email directly to pensions@lafpp.com. You can also visit us on the web at www.lafpp.com.

We look forward to serving you and exceeding your expectations in 2024. Happy New Year from Los Angeles Fire & Police Pensions!