Find all Qualified Survivor forms here. MyLAFPP is the preferred secure option for sending your documents to LAFPP. To find out more about and to access MyLAFPP, please click here.

Frequently Asked Forms

DOMESTIC PARTNERSHIPS

GENERAL

Find all Qualified Survivor forms here. MyLAFPP is the preferred secure option for sending your documents to LAFPP. To find out more about and to access MyLAFPP, please click here.

Frequently Asked Forms

Qualified Surviving Spouse / Domestic Partner may continue their existing health coverage and may also qualify for a health insurance subsidy.

Three months prior to you turning 65, you are required to enroll in Medicare to the fullest extent of your entitlement to continue participation in the Health Subsidy Program. Members who become eligible for Medicare before turning age 65 must contact the Medical and Dental Benefits Section.

Dependents of the Qualified Surviving Spouse / Domestic Partner are not entitled to a health subsidy but may be covered under the survivor’s plan.

If you are currently receiving a Qualified Surviving Spouse / Domestic Partner pension, you qualify for a health insurance subsidy if you meet the following requirements:

Los Angeles Fire and Police Pensions (LAFPP) *Closed to new enrollment*

Los Angeles Firemen’s Relief Association (LAFRA)

Los Angeles Police Relief Association (LAPRA)

United Firefighters of Los Angeles City (UFLAC)

Your monthly subsidy depends on whether you are enrolled in Medicare:

UNFROZEN SUBSIDY: If the retiree either (1) entered DROP or retired prior to July 15, 2011 or (2) chose to opt in during the designated period, the qualified survivor is entitled to the updated monthly subsidy maximum effective January 1st.

*The Maximum Subsidy Amount is based on the retiree’s DROP entry or retirement date.

Amounts shown above are for illustration purposes only. Please click here to view the current subsidy.

FROZEN SUBSIDY: If the retiree either entered DROP or retired on July 15, 2011 or later and chose not to opt in during the designated period, the qualified survivor is entitled to a monthly subsidy maximum of $595.60, the rate effective July 1, 2011.

UNFROZEN SUBSIDY: If the retiree either (1) entered DROP or retired prior to July 15, 2011 or (2) chose to opt in during the designated period, the qualified survivor is subject to the updated monthly subsidy maximum effective January 1st.

Click here to view the current subsidy.

FROZEN SUBSIDY: If the retiree did not choose to opt in during the designated period and entered DROP or retired on July 15, 2011 and later, the qualified survivor is frozen at the monthly subsidy maximum of $480.41, the rate effective July 1, 2011.

*If the retiree had 20 to 25 years of service, the qualified survivor is eligible for 100% of the monthly subsidy maximum as stated. If the retiree had 15 to 19 years of service, the qualified survivor is eligible for 90% of the monthly subsidy maximum as stated. If the retiree had 10 to 14 years of service, the qualified survivor is eligible for 75% of the monthly subsidy maximum as stated.

While you may cover dependents under your plan, please note that the subsidy may only be applied to the cost of the single-party coverage. If the single-party plan premium is higher than your eligible subsidy, the difference (including the premium for dependent coverage, if applicable) will be taken in the form of a deduction on your monthly pension payment. If your eligible subsidy exceeds the single-party plan premium, the unapplied subsidy amount is forfeited and any premium for dependent coverage will be taken in the form of a deduction on your monthly pension payment.

It is not necessary to apply for this benefit. Any eligible retiree or Qualified Surviving Spouse/Domestic Partner enrolled in a Board-approved health plan will automatically receive this benefit.

If you have, please contact the Medical and Dental Benefits Section at (213) 279-3115 or toll-free at (844) 88-LAFPP (52377), Monday-Friday from 7:30 a.m. to 4:30 p.m. (PDT), excluding weekends and City Holidays.

Find all Retired member forms here. MyLAFPP is the preferred secure option for sending your documents to LAFPP. To find out more about and to access MyLAFPP, please click here.

Frequently Asked Forms

Each tax year, after you retire or exit DROP, as a Retired Public Safety Officer, you may be eligible to exclude up to $3,000 from your annual gross income for certain health and insurance premiums.

Health Insurance Premium Reimbursement (HIPR) program participants may qualify for this tax benefit for any premiums paid on or after December 30, 2022.

The Healthcare Enhancement for Local Public Safety Retirees Act (“HELPS Act”) was enacted in Section 845 of the Pension Protection Act of 2006 (“PPA ‘06″). The HELPS Act added section 402(l) to the Internal Revenue Code (“Code”). Section 402(l) permits certain taxpayers to exclude from their gross income distributions up to $3,000 annually from an eligible governmental plan used to pay qualified health insurance premiums of an eligible retired public safety officer and his or her spouse and dependents.

All retired Los Angeles firefighters and police officers who retired on or after achieving eligibility for normal retirement or who retired on a disability retirement meet the definition.

Deferred vested members who left prior to being eligible to retire are not eligible until they have retired from LAFPP.

If you worked as a police officer or firefighter, but retired from the City in a different employment category, you are not eligible for the exclusion.

The retiree can use the exclusion for his or her own premium or for family premiums which also cover a member’s spouse and/or dependent(s). A dependent has to be someone for whom you can take a deduction on your tax return.

Your individual tax advisor or accountant should be consulted if you have any questions about whether someone qualifies as a dependent.

No. A domestic partner is not a spouse. A spouse must be a person to whom you are legally married.

A domestic partner may be claimed as a dependent if he or she otherwise qualifies as a dependent for tax purposes. Again, you should consult with your individual tax advisor if you have any questions about this.

Yes, each of you may exclude the amount of your individual premiums up to $3,000 per year.

Yes, for premiums paid on or before December 29, 2022, LAFPP must have paid the premium to the provider of the accident or health plan or long-term care insurance coverage. Money paid by the retiree did not count prior to December 30, 2022. As such, Health Insurance Premium Reimbursement (HIPR) participants do not qualify for this tax benefit for any premiums they paid prior to December 30, 2022.

However, the Secure 2.0 Act removed this requirement for premiums paid on or after December 30, 2022. HIPR participants may qualify to apply any premiums they paid in excess of the reimbursement received from LAFPP to the tax exclusion as of this date.

No. The total that can be claimed by a retiree for qualified health insurance premiums is the actual amount of the premium(s), up to $3,000 from all sources.

No, the benefit is specific to the retired public safety officer.

No. The coverage is limited to the plans maintained by the City or the employee organizations.

It is an exclusion from income. In order to claim the exclusion, you report the amount of total distributions received from LAFPP (from Box 2a of Form 1099-R) on line 5a of your Form 1040, 1040-SR or 1040-NR. Then, you report the taxable amount (reducing for the exclusion) on line 5b of the Form 1040, 1040-SR or 1040-NR and write “PSO” next to the appropriate line on which you report the taxable income. Again, you should consult with your tax advisor if you have any questions about how to properly report the tax exclusion on your federal income tax form.

No. The exclusion is specific to accident or health insurance or long-term care insurance premiums.

No. The amount of premiums you paid that were not covered by your health subsidy or reimbursement can be eligible for the tax exclusion.

As with all matters involving federal tax law, the rules under Code Section 402(l) are subject to change by further acts of Congress. LAFPP recognizes that the amount of the exclusion ($3,000) has not been increased by Congress for many years. There have been proposals to increase the amount of the exclusion and/or to allow the exclusion to apply to premiums paid by the retiree. LAFPP will update the information provided in this resource if Congress changes the rules for the HELPS Act exclusion.

If you have any questions, please contact the Medical and Dental Benefits Section at (213) 279-3115, toll-free at (844) 88-LAFPP (52377), or via email at mdb@lafpp.com.

Part of your pension may not be taxed based on any after-tax contributions you made to the Plan.

Pension income is subject to federal income tax. However, part of your pension may not be taxed based on any after-tax contributions you made to the Plan. You may have made after-tax contributions for any of the following reasons:

For all other periods, mandatory member contributions were made on a “pre-tax” basis. This means your contributions were deducted from your paycheck before income tax withholding was calculated. These amounts are “tax-free” when you contribute them. Therefore, the pension benefits provided by these contributions are taxable when you receive them during retirement.

You may have contributed both on an after-tax and pre-tax basis. The amount of your after-tax contributions will be returned to you free of federal and state income taxes as you receive your pension. “Basis recovery” is the process by which your after-tax employee pension contributions are returned to you, free of taxes, as part of your pension benefits. We will inform you of the portion of your first payment that is tax-free. The balance of each pension payment will be taxable as ordinary income in the year received. The tax-free amount of your pension will continue until you have recovered all of the after-tax dollars or “basis” you contributed to the Plan. Once your after-tax contributions have been recovered, the entire amount of all future pension payments will be taxable as ordinary income.

The Internal Revenue Code includes a provision that allows DROP members to recover a portion of their eligible after-tax contributions using an accelerated basis recovery method. This method allows you to take a lump sum distribution of any eligible after-tax DROP funds, rather than recovering it in monthly payments over your lifetime through the Simplified Method (explained below). Members exiting DROP on or after January 1, 2014, will be subject to this accelerated basis recovery method and may:

Members exiting DROP must complete the DROP Distribution Election Forms within 90 days of your DROP exit date to determine how you wish to recover your after-tax contributions. After 90 days, the distribution of your DROP account will be limited to a lump sum cash payment only, subject to mandatory 20% Federal tax withholding for the entire account balance.

For pensions effective on or after January 1, 1998, the formula we use to determine the amount of your ongoing monthly pension benefit that is taxable vs. the amount that is tax-free, is the one developed by the IRS. (Also called the “Simplified Method.”) The tax-free portion is based on the amount of your unrecovered after-tax contributions at retirement and your age (plus your spouse’s/domestic partner’s age, if applicable), when you begin to receive pension benefits.

The formula determines the amount of your pension that will not be taxed and the length of time for that exclusion. (See charts below.) By subtracting the tax-free amount from your gross pension for a fixed number of months, your already taxed contributions will be recovered. Cost-of-living pension increases will not change or have any effect on the tax-free amount since the calculation is based upon your total after-tax contributions at retirement.

For Retirees Who Do Not Have a Qualified Surviving Spouse/Domestic Partner

| 55 and under | 360 |

| 56-60 | 310 |

| 61-65 | 260 |

| 66-70 | 210 |

| 71 & over | 160 |

Example: Assume a single retiree at age 55 has a monthly pension of $5,300.13 and total after-tax contributions amount to $48,656.60. The tax excludable amount is $48,656.60 / 360 = $135.16. Therefore, in this example, the taxable amount of the pension is indicated in the right-hand column below:

| $5,300.13 | $135.16 | $5,164.97 |

In this example, the service pension would be fully taxable after 360 months.

For Retirees Who Have a Qualified Surviving Spouse/Domestic Partner

| 110 and under | 410 |

| 111-120 | 360 |

| 121-130 | 310 |

| 131-140 | 260 |

| 141 & over | 210 |

Example: Assume a 55 year-old retiree has a 54 year-old Qualified Surviving Spouse/Domestic Partner, a monthly pension of $5,300.13 and total after-tax contributions amounting to $48,656.60. Using the Simplified Method – Table II, the total amount of monthly payments to recover the after-tax contributions is calculated as follows:

Combined age 55 + 54 = 109. Number of payments for the combined age of 109 is 410. $48,656.60 / 410 = $118.67

Therefore, in this example, the taxable amount of the pension is indicated in the right-hand column below:

| $5,300.13 | $118.67 | $5,181.46 |

In this example, the service pension would be fully taxable after 410 months.

If you have any questions, please call the Retirement Services Section at (213) 279-3125 or toll-free at (844) 88-LAFPP (52377) or email at rs@lafpp.com.

Retired members may be eligible for a monthly subsidy for dental coverage. The dental subsidy is not available to qualified survivors.

If you are a retired member, you qualify for the dental insurance subsidy if you meet the following requirements:

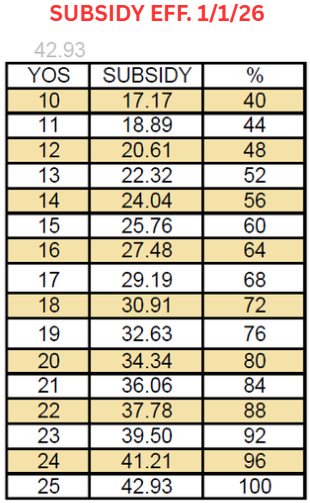

You are allowed 4% of the maximum amount for each year of service (YOS), up to the current monthly maximum subsidy, $42.93.

YOS x 4% x Maximum Subsidy Amount = Monthly Subsidy

It is not necessary to apply for this benefit. Any eligible retiree enrolled in a Board-approved dental plan will automatically receive this benefit.

If you have, please contact the Medical and Dental Benefits Section at (213) 279-3115 or toll-free at (844) 88-LAFPP (52377), Monday-Friday from 7:30 a.m. to 4:30 p.m. (PDT), excluding weekends and City Holidays.

You qualify for a health insurance subsidy if you meet the following requirements:

Department of Fire and Police Pensions (LAFPP)

Los Angeles Firemen’s Relief Association (LAFRA)

Los Angeles Police Relief Association (LAPRA)

United Firefighters of Los Angeles City (UFLAC)

At age 65, you are required to enroll in Medicare to the fullest extent of your entitlement to continue your participation in the Health Subsidy Program. Qualified survivors (e.g., spouse/domestic partner, dependent child) must also be enrolled in Medicare to the full extent of their eligibility at age 65 in order to maintain eligibility for the Health Subsidy Program.

Members who become eligible for Medicare before turning age 65 must contact the Medical and Dental Benefits Section at (213) 279-3115 or by sending an email to: mdb@lafpp.com

YOUR MONTHLY SUBSIDY DEPENDS ON WHETHER YOU ARE ENROLLED IN MEDICARE.

If you are (1) under age 65 and not enrolled in Medicare or, (2) at least age 65 and enrolled in Medicare Part B only, monthly subsidy maximums are calculated as follows:

FORMULA: YOS x 4% x Maximum Subsidy Amount = Monthly Subsidy

Members with an unfrozen subsidy: Members who either (1) entered DROP or retired prior to July 15, 2011 or, (2) chose to opt-in during the designated period are subject to the updated monthly subsidy maximum effective July 1st.

If for example, you have 20 years of service and the maximum subsidy amount is $2,046.97, then the amount of subsidy you will receive toward your health premium is $1,637.58 (20 YOS x 4% x $2,046.97 = $1,637.58).

Note: Amounts shown above are for illustration purposes only. Please click here to view the current subsidy.

Members with a frozen subsidy: Members who chose not to opt-in during the designated period and entered DROP or retired on July 15, 2011 and later are frozen at the monthly subsidy maximum of $1,097.41, the rate effective July 1, 2011.

If for example, you have 20 years of service, $877.93 is your monthly subsidy, which would be applied toward your health premium. (20 YOS x 4% x $1,097.41 = $877.93)

At age 65, if you do not qualify for Medicare Part A, the above formula will be used to calculate your subsidy amount and, additionally, you will not be reimbursed for the cost of the standard Part B premium.

IF YOU ARE ENROLLED IN MEDICARE PARTS A AND B, SUBSIDY FORMULAS ARE PLAN-SPECIFIC AND YOU ARE REIMBURSED THE COST OF THE STANDARD PART B PREMIUM.

If you are enrolled in Medicare Parts A and B, the following monthly subsidy maximums apply:

Members with an UNFROZEN subsidy: Members who either (1) entered DROP or retired prior to July 15, 2011 or (2) chose to opt in during the designated period are subject to the updated monthly subsidy maximum effective January 1st.*

Please click here to view the current subsidy.

Members with a FROZEN subsidy: Members who chose not to opt in during the designated period and entered DROP or retired on July 15, 2011 and later are frozen at the monthly subsidy maximum of $480.41, the rate effective July 1, 2011.*

*Please note that this is the maximum single-party subsidy; Members enrolled in a Medicare plan with covered dependents may qualify for a higher amount.

If the plan premium is higher than your eligible subsidy, the difference will be taken in the form of a deduction from your monthly pension payment. If your eligible subsidy exceeds your plan premium, the unapplied subsidy amount is forfeited.

Any eligible retiree or qualified surviving spouse/ domestic partner enrolled in a Board-approved health plan will automatically receive this benefit.

However, it is recommended that members contact the Association that is administering their active health plan approximately one year before retirement or exiting from DROP to inquire about any special enrollment requirements prior to making the transition to the Association’s retiree health plan.

Members must contact the Association administering their active health plan after their retirement or DROP exit date is finalized in order to complete the required paperwork to make the transition to the Association’s retiree health plan.

Members may also access their eligible subsidy benefit by participating in the Health Insurance Premium Reimbursement Program.

If you have any questions, please contact the Medical and Dental Benefits Section by calling (213) 279-3115 or toll-free at (844) 88-LAFPP, Monday-Friday from 7:30 a.m. to 4:30 p.m. (PDT), excluding weekends and City Holidays. You can also reach us by email at mdb@lafpp.com.

The Health Insurance Premium Reimbursement Program is available to pensioners and Qualified Surviving Spouses/Domestic Partners who meet LAFPP health insurance subsidy eligibility requirements and are not enrolled in a Board-approved health plan provided by:

Members who qualify may receive reimbursement, up to the maximum monthly health insurance subsidy for which they are eligible. Reimbursement will be issued directly to the member, on a quarterly basis, for health insurance premiums paid to a non-Board approved, state-regulated health plan.

By the age 65, you are required to enroll in Medicare to the fullest extent of your entitlement to continue participation in the Health Insurance Premium Reimbursement Program. If you are in a Medicare A and B health plan, you will also receive reimbursement for the Part B basic monthly premium paid upon verification of your Medicare enrollment.

IMPORTANT! If you plan to cancel your current coverage to qualify for this program, please ensure that adequate coverage is obtained prior to submitting the cancellation form. Once cancelled, re-enrollment in a Board-approved health plan will be allowed only under the regular policies of each organization (e.g., relocation, open enrollment, etc.)

You are eligible to participate in the reimbursement program if you:

If you receive a subsidy reimbursement of premiums from LAFPP for a health insurance plan you purchase through a state or federal health insurance exchange, you may NOT claim a federal tax credit under the Pension Protection Act. For any month that LAFPP reimburses your health insurance premiums, you are considered to be in an employer health plan and thus ineligible for federal tax credits toward your out of pocket insurance premiums. Members who are eligible to claim a federal subsidy for a health insurance plan from one of the state or federal health insurance exchanges are encouraged to compare this federal subsidy to their reimbursement eligibility from Fire and Police Pensions. Please contact the Medical and Dental Benefits Section at (213) 279-3115 or (844) 885-2377 if you have questions regarding HIPR and health insurance offered on one of the federal or state health insurance exchanges.

Under the Pension Protection Act of 2006, Section 845, retired public safety officers with a taxable pension who meet eligibility requirements may have a tax exclusion from gross income for up to $3,000 per year for health and dental insurance premiums. Only the premium balance you pay after subtracting any LAFPP subsidy or reimbursement can count toward the tax exclusion. For example, if your health plan premium is $2,000 per month and your LAFPP health subsidy is $1,500 per month, the remaining $500 that is not covered by the subsidy can be included in the total amount you exclude from your taxable income.

For health plan premiums paid on or before December 29, 2022, the premiums must have been directly deducted from your pension check and remitted to your health plan provider by LAFPP to qualify. This provision, known as the “direct payment requirement,” previously barred HIPR participants from claiming the tax exclusion. However, the passage of the Secure 2.0 Act removed this requirement. HIPR participants may be able to apply premium amounts they paid to their health insurers on or after December 30, 2022, to the tax exclusion. Please note, you may only include premiums paid in excess of your HIPR reimbursement towards the amount you exclude from your taxable income. Please contact your tax advisor for more information.

| Coverage Period Within | Claim Forms Received By | Reimbursement Issued |

|---|---|---|

| January 1 – March 31 | NO LATER THAN April 15 | May 31 |

| April 1 – June 30 | July 15 | August 31 |

| July 1 – September 30 | October 15 | November 30 |

| October 1 – December 31 | January 15 | February 28 |

Note: Claim forms received after the deadline will be processed according to the payment schedule for the following quarter. Claim forms received later than 12 months after the end of the coverage period will not be processed.

If you have, please contact the Medical and Dental Benefits Section at (213) 279-3115 or toll-free at (844) 88-LAFPP, Monday-Friday from 7:30 a.m. to 4:30 p.m. (PDT), excluding weekends and City Holidays.

The Survivor Benefit Purchase Program allows a retired member to purchase a survivor benefit for a spouse married in retirement or a domestic partner declared in retirement.

Note: If the retired member’s death occurs less than one year from the date of his/her election and the accidental death exception does not apply, there is no survivor benefit. Instead, the amount by which the retired member’s pension was reduced shall then be paid as a lump sum to the spouse/domestic partner. If both the spouse/domestic partner and the member die during the one year vesting period and the spouse/domestic partner predeceases the member, then the lump sum shall be paid to the member’s estate.

In the event a member becomes incapable of electing to participate in the Survivor Benefit Purchase Program, his/her Statutory Power of Attorney may include language that provides sufficient authority to an Agent to act on his/her behalf. As such, members who wish to delegate this authority to their Agent should review the Statutory Power of Attorney Information.

If you are interested in the Survivor Benefit Purchase Program, you may submit a Request Information to Purchase Survivor Benefits Form.

If you have any questions, you may contact the Retirement Services Section by email (rs@lafpp.com) or by phone at (213) 279-3125 or toll-free at (844) 88-LAFPP.

Find all DROP Member forms here. MyLAFPP is the preferred secure option for sending your documents to LAFPP. To find out more about and to access MyLAFPP, please click here.