We invite you to read our newsletter filled with announcements and benefit topics including the Mandatory DROP Exit Counseling Sessions, Former Spouses as Beneficiaries, Annual Compensation Limit, and more.

Click here to view Newsletter.

We invite you to read our newsletter filled with announcements and benefit topics including the Mandatory DROP Exit Counseling Sessions, Former Spouses as Beneficiaries, Annual Compensation Limit, and more.

Click here to view Newsletter.

We invite you to read our newsletter filled with announcements and benefit topics including lost service time and how it affects you, domestic partnership, and more.

Click here to view Newsletter.

We invite you to read our newsletter filled with announcements and benefit topics including the 2024 Active Member Annual Statements, Strategic Plan Member Survey, and more.

Click here to view Newsletter.

We invite you to read our newsletter filled with announcements and benefit topics including a special message to LAFPP members, the Social Security Fairness Act, Call to Action, and more.

Click here to view Newsletter!

Article updated on February 25, 2025

Latest Update on the Social Security Fairness Act

The Social Security Administration has announced the immediate start of retroactive payments and an increase in monthly benefit payments for individuals affected by the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). These provisions previously reduced or eliminated benefits for over 3.2 million people with non-covered pensions. The Social Security Fairness Act, which ends WEP and GPO, will provide retroactive payments by the end of March and higher monthly benefits starting in April, though complex cases may take longer to process. Beneficiaries will be notified by mail about these changes but they are advised to wait until April before contacting Social Security about the adjustments.

View a copy of the official press release at https://www.ssa.gov/news/press/releases/2025/#2025-02-25-a

Visit the official agency’s Social Security Fairness Act webpage: https://www.ssa.gov/benefits/retirement/social-security-fairness-act.html

The article below was originally posted on January 6, 2025:

On January 5, 2025, President Biden signed into law the Social Security Fairness Act of 2023 (H.R. 82), which repeals two long-standing federal laws: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These provisions reduced Social Security payments for recipients of other benefits such as a pension from state or local government, impacting almost three million individuals, including some LAFPP retirees and beneficiaries.

What Are WEP and GPO?

WEP and GPO are federal laws that reduce Social Security benefits for individuals who also receive a pension from work not covered by Social Security, such as City of Los Angeles employees.

Impact of the Repeal

It is unclear at this time how quickly the Social Security Administration (SSA) will be able to recalculate benefit amounts for those impacted by WEP and GPO. Individuals who may have seen their Social Security benefits reduced by these provisions are encouraged to speak with a Social Security Administration representative. Please note that this change DOES NOT IMPACT benefits received from LAFPP.

What Should You Do?

For specific questions about how the repeal will impact your individual Social Security benefits, it is recommended to contact the SSA directly. Visit www.ssa.gov for updates and detailed information.

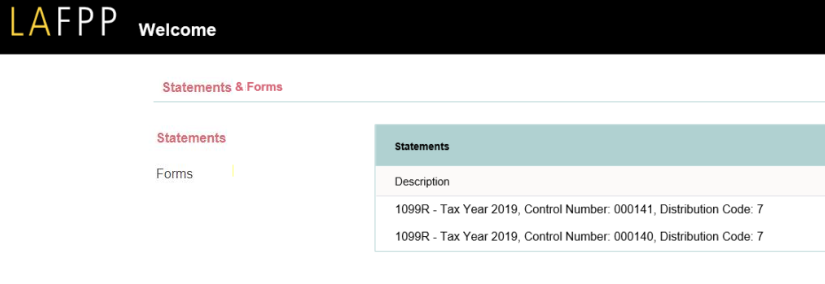

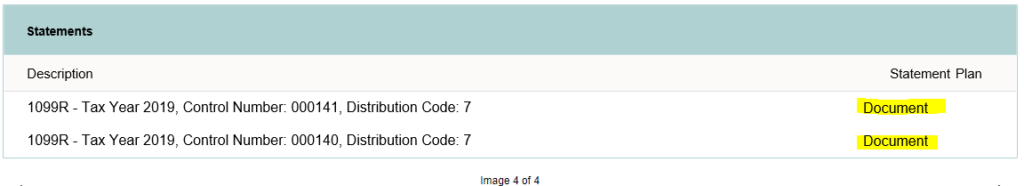

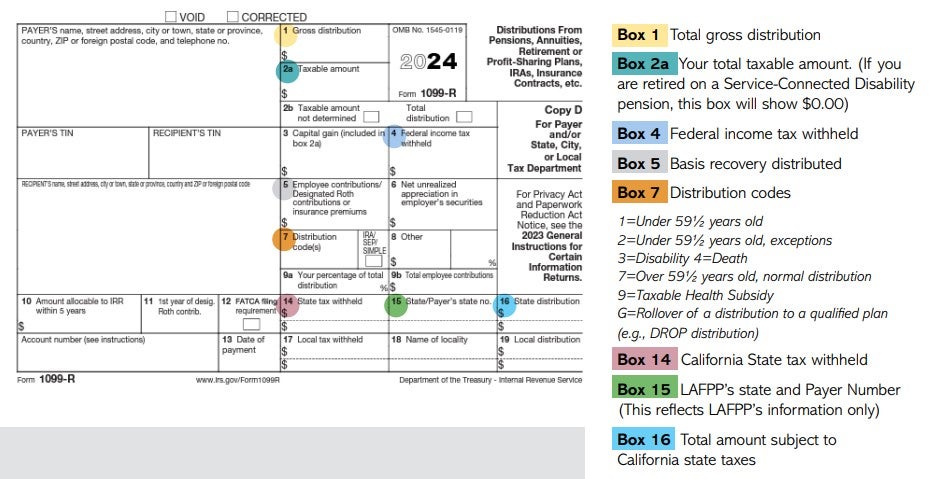

As you prepare to file your taxes, below are a couple of options for obtaining your 2024 Form 1099-R tax information:

Available online beginning January 31, 2025

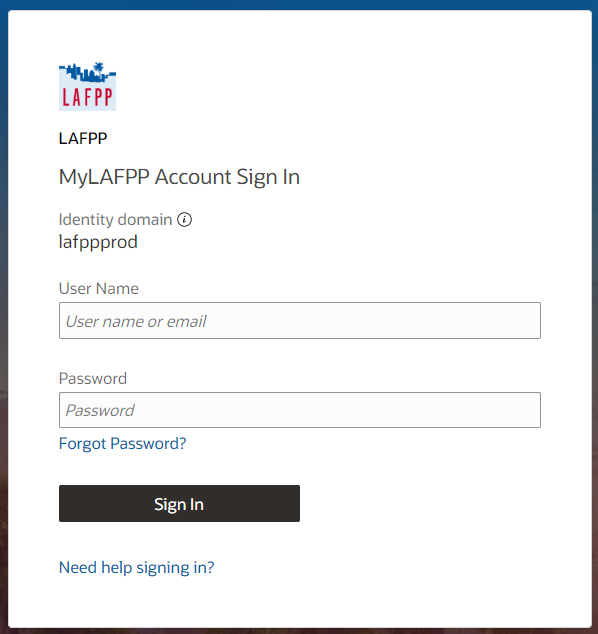

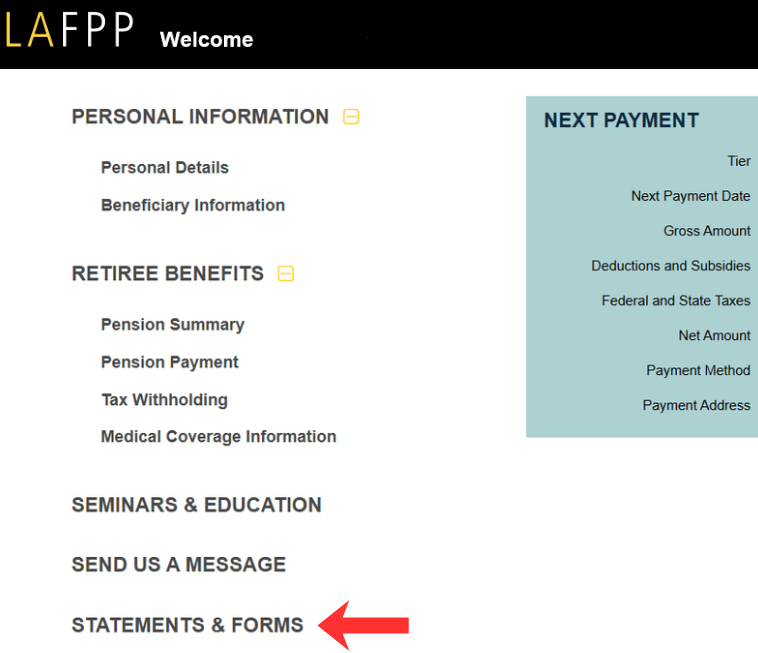

You may view and/or print a copy of your 1099-R tax form by logging into your MyLAFPP portal. See below for a tutorial on how to access MyLAFPP.

Mailed on January 31, 2025

If you prefer to wait for a hard copy of your 1099-R tax form, it will be mailed to your address on file via U.S. mail on January 31, 2025. Please allow up to 10 business days to receive your 1099-R by mail. If you have not received your 1099-R form by February 15, 2025, please contact the Accounting Section at (213) 279-3040, (844) 88-LAFPP ext. 3040, or via email at accounting@lafpp.com to request a copy.

FAQs

Important: In order to access your information, you must first register to the MyLAFPP member portal. Please refer to the Register to MyLAFPP manual located in our MyLAFPP Helpdesk.

Important: Passwords are case sensitive.

If you live in the state of California, you can make changes electronically through the MyLAFPP portal in 6 easy steps:

Click here to view screenshots of the step-by-step instructions above.

If you live outside of the state of California, current system limitations do not allow you to update your tax withholding elections using the MyLAFPP portal. For assistance, please contact the Retirement Services Section at (213) 279-3125 or (844) 88-LAFPP, ext. 3125.

Important Note: In addition to Federal taxes, LAFPP will withhold state taxes for the State of California. If you reside outside the state of California, no state taxes will be withheld, and you will be responsible for any required state tax withholdings. The State tax withheld (Box 14) and State distribution (Box 16) on your Form 1099-R will be populated with $0.00.

Tax year 2024 Forms 1099-R: The State/Payer’s State No. (Box 15) will continue to reflect the LAFPP Tax ID CA/800-7968-4 regardless of your state of residence. Box 15 is an administrative Form 1099-R field for California payers.

For questions, please contact the Retirement Services Section at (213) 279-3125 or (844) 88-LAFPP, ext. 3125 or by email at rs@lafpp.com.

As our City faces the ongoing challenges brought on by the devastating fires, we want to take a moment to extend our deepest gratitude to the brave first responders who are on the front lines, working tirelessly to protect our community. We also recognize the toll that such intense and sustained efforts may take, and we want to ensure that our members and their families have the support they need during these challenging times.

We want to assure you that our offices remain open and ready to assist you with all services. In addition, we’ve provided some resources below to assist in accessing support:

Thank you once again for everything you do. Stay safe!

Important Update from the City’s ITA Information Security Office

Phishing Scams Targeting Wildfire Victims

The California Cybersecurity Integration Center (CAL-CSIC) has issued a warning about phishing scams exploiting the current Southern California wildfires. Be extremely cautious of emails, texts, or social media posts related to wildfire relief, donations, or recovery efforts. Do not click on any links or open any attachments in emails or messages unless you are absolutely certain of their source.

How to protect yourself from these scams: Be wary of urgent or alarming messages that try to pressure you into taking immediate action. Do not click on links contained in any email or text message related to the Southern California wildfires. Instead, manually visit the organization’s website. Be cautious of misspelled URLs or unusual domain extensions. Avoid making charitable donations using cash. Instead, use traceable/legitimate services. Trust your instincts: if something seems suspicious or too good to be true, it likely is. Do not let cybercriminals take advantage!

Ways to Donate

*Please note these donation pages and resources are not sponsored by the LAFPP but rather by independent resources*

This season, we extend our warmest holiday wishes to our members from LAPD, LAFD, Harbor, and Airport and their families who have dedicated their lives to ensuring the safety of our City. The holidays are a time for reminiscing and creating new memories with our loved ones.

May this festive season bring you and your family moments of joy, love, laughter, and togetherness.

In observance of the holiday, our offices will be closed Wednesday, December 25, 2024. We will resume normal business hours on Thursday, December 26, 2024.

For account information, please log in to MyLAFPP. MyLAFPP is the designated online portal where Active/DROP and Retired members and their beneficiaries have 24-hour access to personalized pension benefit information and services. You may view and/or update the following:

From the Los Angeles Fire and Police Pensions family to yours, Happy Holidays!

SPECIAL NOTICE: This article only applies to eligible retired members of Los Angeles Fire and Police Pensions and respective Qualified Surviving Spouses/Domestic Partners.

The Centers for Medicare and Medicaid Services (CMS) has announced the new standard Medicare Part B monthly premium for 2025 is $185.00. However, some pensioners may pay less than this amount, as CMS does not increase a Medicare Part B participant’s premium by more than the dollar increase of their Social Security cost of living adjustment. This is known as the “Hold Harmless Rule” and applies to all participants who have their Medicare Part B premium deducted directly from their Social Security check and who do not pay Income Related Monthly Adjustment Amounts, or IRMAAs.

Please submit a copy of:

Please submit a copy of your:

Please redact any birthdate or SSN information and send all documents to LAFPP’s Medical and Dental Benefits Section via:

Due to the anticipated high volume of submissions, it may take approximately three months to process your Part B documentation and update your reimbursement amount on your LAFPP pension payment.

As a reminder, Part B reimbursement only applies to Retired Members or Qualified Survivors who are eligible for an LAFPP health subsidy and are enrolled in both Medicare Parts A and B. Any additional Part B penalties or fees charged by CMS are not eligible for reimbursement.

1. How do I know if I am eligible for Part B reimbursement?

You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

2. What document do I need to submit to receive my correct Part B reimbursement amount?

You must submit a copy of your Social Security benefits verification statement (your “New Benefit Amount”) or a copy of a 2025 Centers for Medicare and Medicaid Services (CMS) billing statement.

3. My spouse (non-LAFPP member) is currently enrolled in Medicare Parts A and B. Does he/she need to submit Medicare Part B premium documentation?

No. Only the retired member or Qualified Survivor enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement.

4. I received a letter stating that I pay a higher Part B premium based on my income level (Income-Related Monthly Adjustment Amount – “IRMAA”). May I submit this letter as proof of my Part B premium?

Yes. You may submit a copy of the first page of your IRMAA letter if it contains your name, address and 2025 monthly Medicare Part B premium deduction. LAFPP does not reimburse IRMAA fees, so your Part B reimbursement will not exceed the 2025 standard monthly premium of $185.00.

5. I receive a monthly Social Security payment, but I did not receive/cannot locate my “New Benefit Amount” Statement from Social Security. What should I do?

You may call or visit your local Social Security Administration (SSA) office. You may also access proof of your 2025 Medicare Part B basic premium online at the SSA website: www.ssa.gov/myaccount. You may be required to create or register your SSA account. Please note that once you have an online account, your SSA notifications will be emailed to you.

6. When do I need to provide LAFPP documentation of my Part B Premium?

You may submit your documentation as soon as it is available and receive a retroactive reimbursement for up to twelve (12) pension roll months from the date your submission is received.

If you have additional questions about your Medicare Part B reimbursement, please contact the Medical and Dental Benefits Section at (213) 279-3115, toll free at (844) 88-LAFPP ext. 3115, or via email to mdb@lafpp.com.

SPECIAL NOTICE: This article only applies to eligible retired members of Los Angeles Fire and Police Pensions and respective Qualified Surviving Spouses/Domestic Partners.

The Centers for Medicare and Medicaid Services (CMS) has announced the new standard Medicare Part B monthly premium for 2026 is $202.90. However, some pensioners may pay less than this amount, as CMS does not increase a Medicare Part B participant’s premium by more than the dollar increase of their Social Security cost of living adjustment. This is known as the “Hold Harmless Rule” and applies to all participants who have their Medicare Part B premium deducted directly from their Social Security check and who do not pay Income Related Monthly Adjustment Amounts, or IRMAAs.

Please submit a copy of:

Please submit a copy of your:

Please redact any birthdate or SSN information and send all documents to LAFPP’s Medical and Dental Benefits Section via:

Due to the anticipated high volume of submissions, it may take approximately three months to process your Part B documentation and update your reimbursement amount on your LAFPP pension payment.

As a reminder, Part B reimbursement only applies to Retired Members or Qualified Survivors who are eligible for an LAFPP health subsidy and are enrolled in both Medicare Parts A and B. Any additional Part B penalties or fees charged by CMS are not eligible for reimbursement.

1. How do I know if I am eligible for Part B reimbursement?

You must be a retired member or qualified survivor who is receiving a pension, is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

2. What document do I need to submit to receive my correct Part B reimbursement amount?

You must submit a copy of your Social Security benefits verification statement (your “New Benefit Amount”) or a copy of a 2026 Centers for Medicare and Medicaid Services (CMS) billing statement.

3. My spouse (non-LAFPP member) is currently enrolled in Medicare Parts A and B. Does he/she need to submit Medicare Part B premium documentation?

No. Only the retired member or Qualified Survivor enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement.

4. I received a letter stating that I pay a higher Part B premium based on my income level (Income-Related Monthly Adjustment Amount – “IRMAA”). May I submit this letter as proof of my Part B premium?

Yes. You may submit a copy of the first page of your IRMAA letter if it contains your name, address and 2026 monthly Medicare Part B premium deduction. LAFPP does not reimburse IRMAA fees, so your Medicare Part B reimbursement will not exceed the 2026 standard monthly premium of $202.90.

5. I receive a monthly Social Security payment, but I did not receive/cannot locate my “New Benefit Amount” Statement from Social Security. What should I do?

You may call or visit your local Social Security Administration (SSA) office. You may also access proof of your 2026 Medicare Part B basic premium online at the SSA website: www.ssa.gov/myaccount. You may be required to create or register your SSA account. Please note that once you have an online account, your SSA notifications will be emailed to you.

6. When do I need to provide LAFPP documentation of my Part B Premium?

You may submit your documentation as soon as it is available and receive a retroactive reimbursement for up to twelve (12) pension roll months from the date your submission is received.

If you have additional questions about your Medicare Part B reimbursement, please contact the Medical and Dental Benefits Section at (213) 279-3115, toll free at (844) 88-LAFPP ext. 3115, or via email to mdb@lafpp.com.