As you prepare to file your taxes, below are a couple of options for obtaining your 2025 Form 1099-R tax information:

Available online beginning January 31, 2026

You may view and/or print a copy of your 1099-R tax form by logging into your MyLAFPP portal. Click here for a tutorial on how to access MyLAFPP.

Mailed by January 31, 2026

If you prefer to wait for a hard copy of your 1099-R tax form, it will be mailed to your address on file via U.S. mail by January 31, 2026. Please allow up to 10 business days to receive your 1099-R by mail. If you have not received your 1099-R form by February 15, 2026, you may request a copy by contacting the Accounting Section at (213) 279-3040, (844) 88-LAFPP ext. 3040, or via email at PensionAccounting@lafpp.com.

FAQs

MyLAFPP tutorial how to download your 1099-R

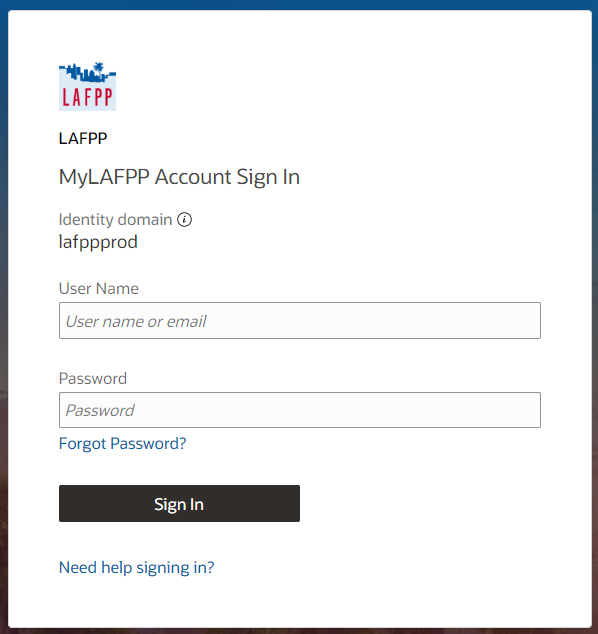

Important: In order to access your information, you must first register to the MyLAFPP member portal. Please refer to the Register to MyLAFPP manual located in our MyLAFPP Helpdesk.

STEP 1: Log in to MyLAFPP. Enter your username and password, then click Log In.

Important: Passwords are case sensitive.

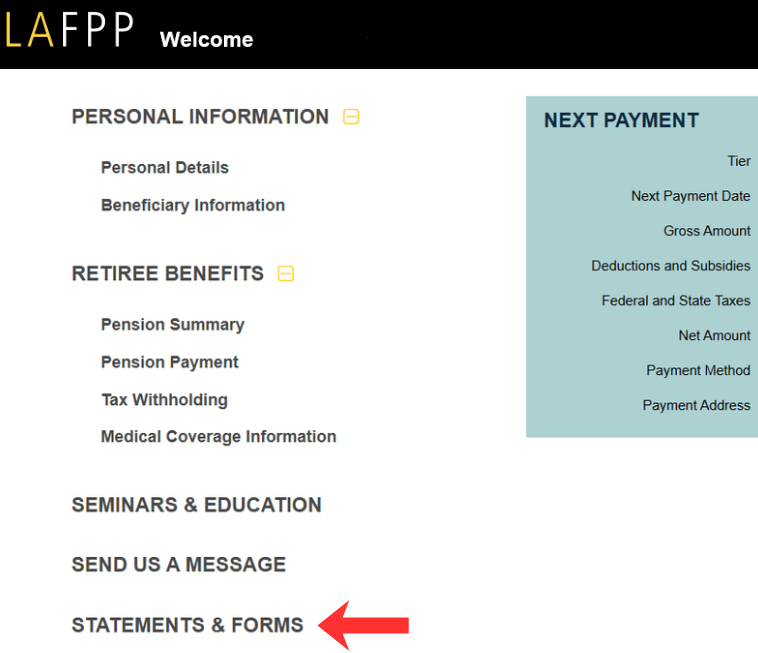

STEP 2: Click on “Statements & Forms”

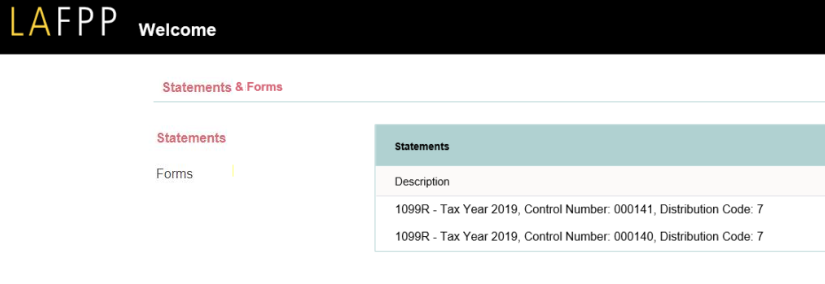

STEP 3: Click “Statements”

STEP 4: Click “Document” to Open or Download Your Form 1099R

Some members may receive more than one 1099-R tax form in a year. Here are some possible reasons why:

- You exited DROP and received the proceeds of your DROP account via a rollover, a lump-sum cash distribution, and received at least one monthly pension check in the same year. In this case, you would receive multiple 1099-Rs. One 1099-R for the DROP rollover (Distribution Code G), one 1099-R for the DROP lump-sum (Distribution Code 2), and at least one 1099-R for monthly pension payments (also Distribution Code 2 and/or Distribution Code 7 if you were age 59 ½ or older).

- You have a non-tax dependent covered on your LAFPP-subsidized health insurance plan (e.g., domestic partner or child of a domestic partner). This 1099-R would have a Distribution Code 9.

- Your IRS tax distribution code changed during the year (i.e., when member attains age 59 ½ by June of the same year). You would receive two 1099-Rs, one for when you were under the age of 59 ½ (Distribution Code 2) and another for when you were age 59 ½ or older (Distribution Code 7).

- You received pension payments based on your City service and from a qualified domestic relations order (QDRO) (Distribution Code 2) or as a beneficiary (Distribution Code 4).

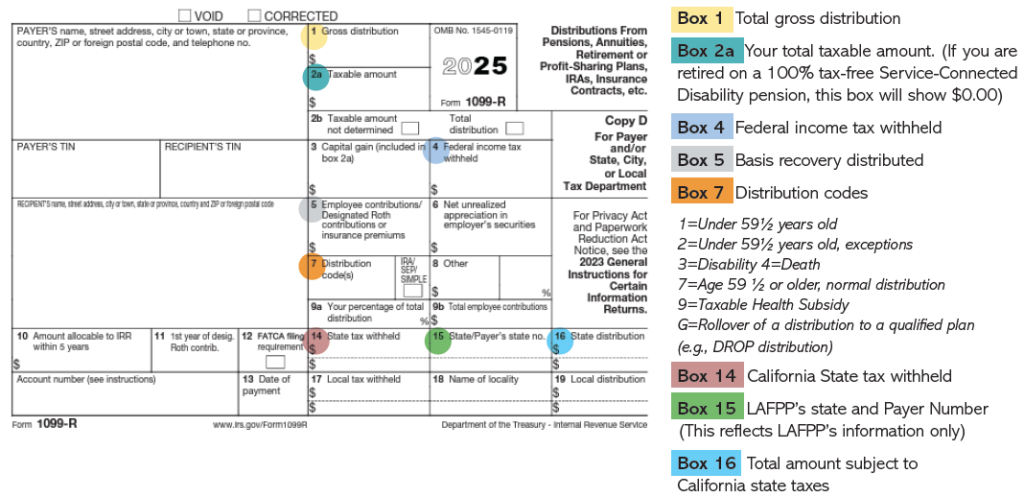

What does each box represent on the 1099-R?

Need to make changes to your income tax withholdings?

If you live in the state of California, you can make changes electronically through the MyLAFPP portal in 6 easy steps:

- Access MyLAFPP

- Click Retiree Benefits

- Click Tax Withholding

- Click Update Pension Tax Withholding Instructions

- Fill in all the information, even if you are only changing either Federal or State of California withholdings.

- Click Submit

Click here to view screenshots of the step-by-step instructions above.

If you live outside of the state of California, current system limitations do not allow you to update your tax withholding elections using the MyLAFPP portal. For assistance, please contact the Retirement Services Section at (213) 279-3125 or (844) 88-LAFPP, ext. 3125.

Important Note: In addition to Federal taxes, LAFPP is responsible for tax withholding only in the state of California. Since LAFPP does not have an operating business presence in other states, we do not offer tax withholding for states other than California. If you reside outside the state of California, no state taxes will be withheld. The State tax withheld (Box 14) and State distribution (Box 16) on your Form 1099-R will be populated with $0.00 if you were a resident of a state other than California for the entire year.

Tax year 2025 Forms 1099-R: The State/Payer’s State No. (Box 15) will continue to reflect the LAFPP Tax ID CA/800-7968-4 regardless of your state of residence. Box 15 is an administrative Form 1099-R field for California payers.

For questions, please contact the Retirement Services Section at (213) 279-3125 or (844) 88-LAFPP, ext. 3125 or by email at rs@lafpp.com.